Oct 2 - London stocks gave up early gains and closed lower on Monday as rising yields pushed equities down, while defence firm BAE Systems was among the few bright spots on the large-cap index after winning a contract to build attack submarines.

"UK yields are also pushing higher after last week's upward revisions to GDP, with bond investors seemingly concerned that the Bank of England may have to hike rates again between now and the end of the year," Michael Hewson, chief market analyst at CMC Markets UK, said. Domestic manufacturing activity slowed sharply in September, though less steeply than the month before when it shrank at the fastest rate in more than three years, a survey showed.

Italia Ultime Notizie, Italia Notizie

Similar News:Puoi anche leggere notizie simili a questa che abbiamo raccolto da altre fonti di notizie.

London on Cusp of Becoming Biggest Stock Market in Europe, AgainBritain’s stock market is getting back on its feet.

London on Cusp of Becoming Biggest Stock Market in Europe, AgainBritain’s stock market is getting back on its feet.

Leggi di più »

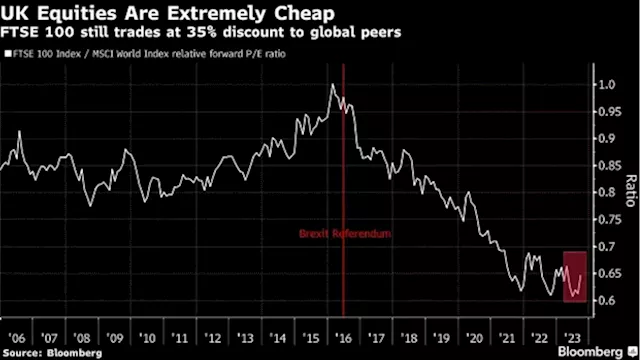

London on Cusp of Becoming Biggest Stock Market in Europe, Again(Bloomberg) -- Britain’s stock market is getting back on its feet.Most Read from BloombergSenate Voting on Bill to Avert US Government ShutdownOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineEurope’s Richest Royal Family Builds $300 Billion Finance EmpireWeight-Loss Drugs Estimated to Save Airlines MillionsLess than a year after losing the crown of Europe’s biggest equity market, London looks set to recapture it from Paris, a

London on Cusp of Becoming Biggest Stock Market in Europe, Again(Bloomberg) -- Britain’s stock market is getting back on its feet.Most Read from BloombergSenate Voting on Bill to Avert US Government ShutdownOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineEurope’s Richest Royal Family Builds $300 Billion Finance EmpireWeight-Loss Drugs Estimated to Save Airlines MillionsLess than a year after losing the crown of Europe’s biggest equity market, London looks set to recapture it from Paris, a

Leggi di più »

In the Market: US bond market signals the end of an eraThe U.S. bond market is calling a moment: the age of low interest rates and inflation that began with the 2008 financial crisis has ended. The market's view has come into sharp focus in recent days amid a dramatic run-up in 10-year Treasury yields that hit 16-year highs. Behind that move is a bet that the disinflationary forces the Federal Reserve fought with its easy money policies in the aftermath of the financial crisis have abated, according to investors and a regularly updated New York Fed model based on yields.

In the Market: US bond market signals the end of an eraThe U.S. bond market is calling a moment: the age of low interest rates and inflation that began with the 2008 financial crisis has ended. The market's view has come into sharp focus in recent days amid a dramatic run-up in 10-year Treasury yields that hit 16-year highs. Behind that move is a bet that the disinflationary forces the Federal Reserve fought with its easy money policies in the aftermath of the financial crisis have abated, according to investors and a regularly updated New York Fed model based on yields.

Leggi di più »

In the Market: US bond market signals the end of an eraBy Paritosh Bansal (Reuters) - The U.S. bond market is calling a moment: the age of low interest rates and inflation that began with the 2008 financial ...

In the Market: US bond market signals the end of an eraBy Paritosh Bansal (Reuters) - The U.S. bond market is calling a moment: the age of low interest rates and inflation that began with the 2008 financial ...

Leggi di più »

US futures steady after lawmakers avert shutdown: Stock market news todayStocks lost hold of earlier premarket gains as investors weighed what the deal to avert shutdown means.

US futures steady after lawmakers avert shutdown: Stock market news todayStocks lost hold of earlier premarket gains as investors weighed what the deal to avert shutdown means.

Leggi di più »

Prairie Grid Dinner & Market event | Watch News Videos OnlineWatch Prairie Grid Dinner & Market event Video Online, on GlobalNews.ca

Prairie Grid Dinner & Market event | Watch News Videos OnlineWatch Prairie Grid Dinner & Market event Video Online, on GlobalNews.ca

Leggi di più »