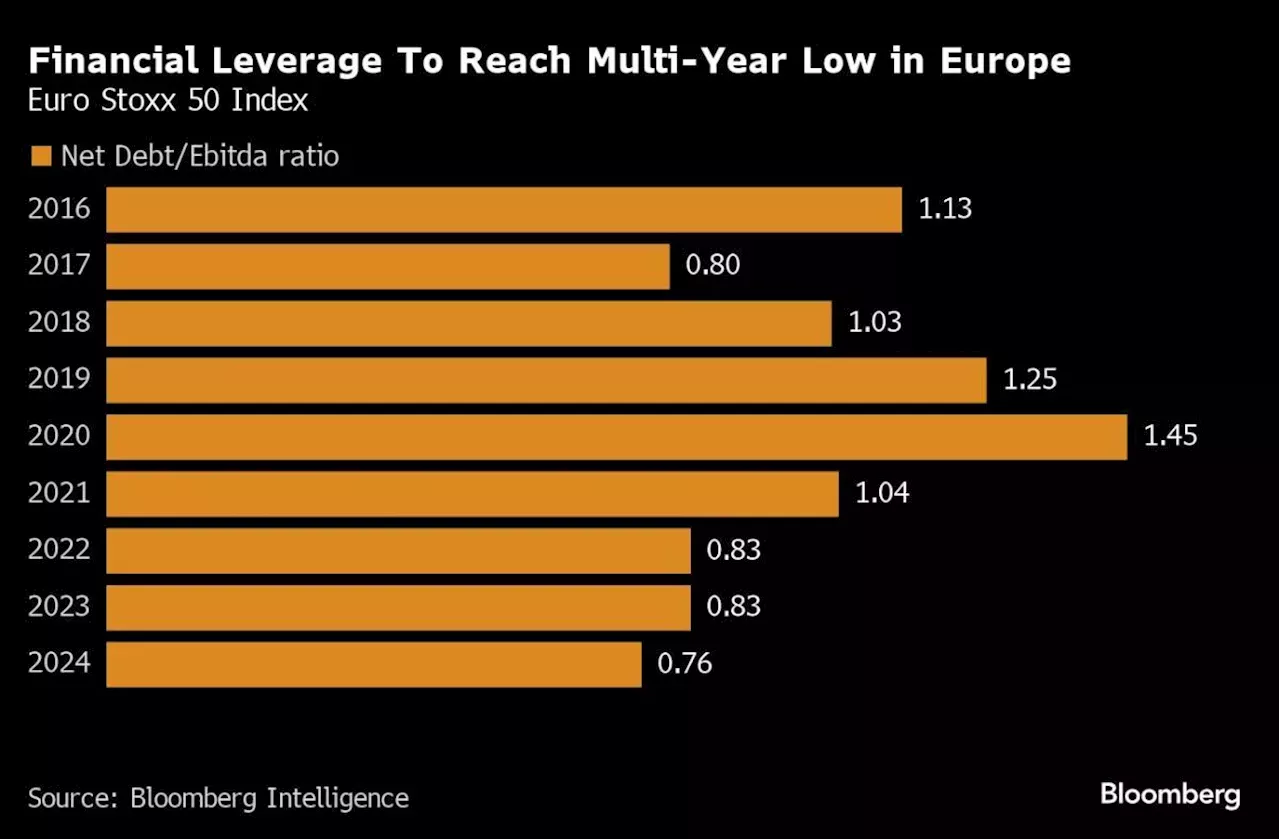

-- Financial leverage at Europe’s biggest companies is expected to ease this year to the lowest since 2008 and the global financial crisis, potentially allowing for more dividends, buybacks and M&A.Ambani's $600 Million Wedding Is Just Business as Usual

The Euro Stoxx 50 index in any case represents the “high quality, low leverage, pretty high margin top end of the market,” Fowler said. He cited companies like chipmaking equipment manufacturer ASML Holding NV, obesity-fighting drug producer Novo Nordisk A/S and industrial gas supplier Air Liquide SA as among those best exemplifying those attributes.

“The flood gates aren’t open because there is still a concern around pockets of volatility and the sellers would like the valuations to be higher,” Fowler said. “But if European valuations were to rise a bit further, if some of the election-related risks started to subside, then I think that there will be a pretty steady, if not rapidly growing stream of IPOs.

Cathie Wood says she wouldn't have sold Nvidia stake 'had we known that the market was going to reward it'

Italia Ultime Notizie, Italia Notizie

Similar News:Puoi anche leggere notizie simili a questa che abbiamo raccolto da altre fonti di notizie.

Unhappy with new greenwashing rules, Alberta and fossil fuel companies push backRebecca Schultz, Alberta Minister of the Environment and Protected Areas at the press conference by the Canadian Council of Ministers of Environment following their meeting in St. John's on Wednesday, July 10, 2024.

Unhappy with new greenwashing rules, Alberta and fossil fuel companies push backRebecca Schultz, Alberta Minister of the Environment and Protected Areas at the press conference by the Canadian Council of Ministers of Environment following their meeting in St. John's on Wednesday, July 10, 2024.

Leggi di più »

AI may be a hot topic, but how fast are companies adopting?While AI is all the rage in boardroom meetings and earnings reports, actual adoption may not be as widespread as the impression the corporate world is giving...

AI may be a hot topic, but how fast are companies adopting?While AI is all the rage in boardroom meetings and earnings reports, actual adoption may not be as widespread as the impression the corporate world is giving...

Leggi di più »

Mining companies, suppliers team up to advance evolving ESG goalsThe South African mining industry continues to be a key contributor to the fiscus, with local producers and suppliers paying about R14-billion in royalties and R90-billion in taxes in the year ended December 31, 2023, and investing billions of rands in environmental, social and governance (ESG) initiatives.

Mining companies, suppliers team up to advance evolving ESG goalsThe South African mining industry continues to be a key contributor to the fiscus, with local producers and suppliers paying about R14-billion in royalties and R90-billion in taxes in the year ended December 31, 2023, and investing billions of rands in environmental, social and governance (ESG) initiatives.

Leggi di più »

Mining companies, suppliers team up to advance evolving ESG goalsThe South African mining industry continues to be a key contributor to the fiscus, with local producers and suppliers paying about R14-billion in royalties and R90-billion in taxes in the year ended December 31, 2023, and investing billions of rands in environmental, social and governance (ESG) initiatives.

Mining companies, suppliers team up to advance evolving ESG goalsThe South African mining industry continues to be a key contributor to the fiscus, with local producers and suppliers paying about R14-billion in royalties and R90-billion in taxes in the year ended December 31, 2023, and investing billions of rands in environmental, social and governance (ESG) initiatives.

Leggi di più »

US companies head into earnings facing high expectationsU.S. companies releasing quarterly results in the coming weeks face investors who expect no less than stellar growth, with estimates particularly high for...

US companies head into earnings facing high expectationsU.S. companies releasing quarterly results in the coming weeks face investors who expect no less than stellar growth, with estimates particularly high for...

Leggi di più »

Additional auto insurance companies could leave Alberta without system reforms: DBRSA major global credit rating agency says Alberta must come up with a 'clear long-term solution' to its auto insurance woes or additional insurers will depart the province.

Additional auto insurance companies could leave Alberta without system reforms: DBRSA major global credit rating agency says Alberta must come up with a 'clear long-term solution' to its auto insurance woes or additional insurers will depart the province.

Leggi di più »