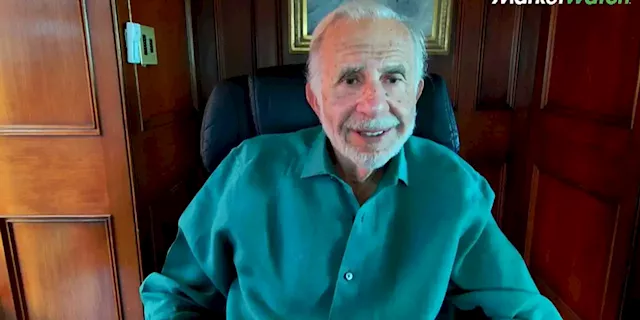

Icahn Enterprises LP’s stock IEP rose 6% premarket Friday, after closing down almost 2% on Thursday, after short seller Hindenburg Research intensified his bearish bet on Carl Icahn’s investing arm, and said he was taking aim at its bonds. Hindenburg, run by Nate Anderson, said the latest disclosures made Wednesday by IEP raised more questions about Icahn’s personal margin loans, or debt, from the company as well as portfolio losses at IEP.

For more, see: Icahn stock renews skid as Hindenburg says latest company disclosure raises more questions about company debt, losses

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Icahn Enterprises stock slides 9% after company swings to first-quarter lossIcahn Enterprises L.P., the investing arm of billionaire activist investor Carl Icahn, said Wednesday it swung to a loss in the first quarter.

Icahn Enterprises stock slides 9% after company swings to first-quarter lossIcahn Enterprises L.P., the investing arm of billionaire activist investor Carl Icahn, said Wednesday it swung to a loss in the first quarter.

続きを読む »

Carl Icahn's company stock falls as much as 20% after prosecutors seek financial informationRegulators contacted Icahn Enterprises last Wednesday seeking information about corporate governance and other materials.

Carl Icahn's company stock falls as much as 20% after prosecutors seek financial informationRegulators contacted Icahn Enterprises last Wednesday seeking information about corporate governance and other materials.

続きを読む »