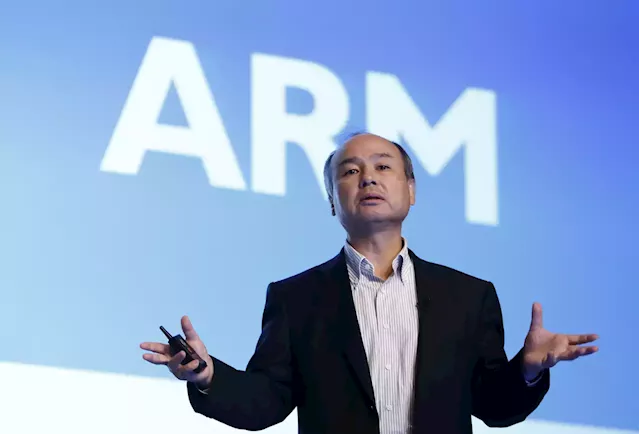

The announcement that Arm had filed for an initial public offering and would likely soon begin a roadshow has IPO watchers giddy with hopes that a two-year drought is slowly coming to an end, particularly for tech unicorns. On the surface, it sounds promising. The current estimated valuation of the company is in the $60 billion range. If the company floats 10% of that , the IPO would raise roughly $6 billion. That would make it the largest IPO since Rivian went public at $11.

" Here, Arm could make a big difference. It's implied current valuation of $64 billion is based on the 25% stake Softbank bought in ARM from Vision Group for $16 billion. But investors may balk at that valuation. If it prices significantly below that, it will send a further signal that haircuts will be necessary for other companies. That's already happening.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

What ARM's expected debut means for the IPO market and SoftBankArm, which is owned by SoftBank, is expected to file for its initial public offering as soon as Monday, according to reports.

What ARM's expected debut means for the IPO market and SoftBankArm, which is owned by SoftBank, is expected to file for its initial public offering as soon as Monday, according to reports.

続きを読む »