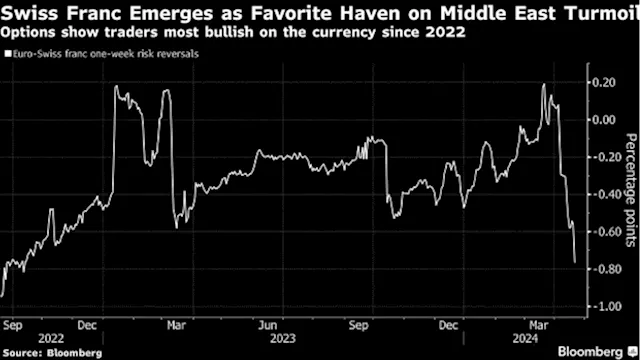

-- Currency markets are in full risk-off mode amid fears of a widening conflict in the Middle East, with traders rushing for safe havens in both spot and options.The dollar gained versus all Group-of-10 currencies except for the Swiss franc and the Japanese yen on Friday, after reports that Israel launched a retaliatory strike on Iran. The Bloomberg Dollar Spot Index rose for a seventh day in eight.Options also point to a rush for safe havens.

The developments fueled volatility in oil-linked currencies as crude briefly soared above $90 a barrel. The cost of hedging one-week moves on the Canadian dollar rose the most in 15 months on Friday, while Norwegian krone volatility headed for its second-biggest gain this year. Net Worth for Baby Boomers: How To Tell Whether You’re Poor, Middle Class, Upper Middle Class or Rich

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Currency Traders Turn to Options Market for Geopolitical HavensCurrency markets are in full risk-off mode amid fears of a widening conflict in the Middle East, with traders rushing for safe havens in both spot and options.

Currency Traders Turn to Options Market for Geopolitical HavensCurrency markets are in full risk-off mode amid fears of a widening conflict in the Middle East, with traders rushing for safe havens in both spot and options.

続きを読む »