-- Next week’s US inflation print looms as key for the trajectory of equities and wagers on Federal Reserve interest rate cuts, according to Morgan Stanley strategists.Xi Begins Europe Tour in Paris as Macron Seeks to Reset Ties

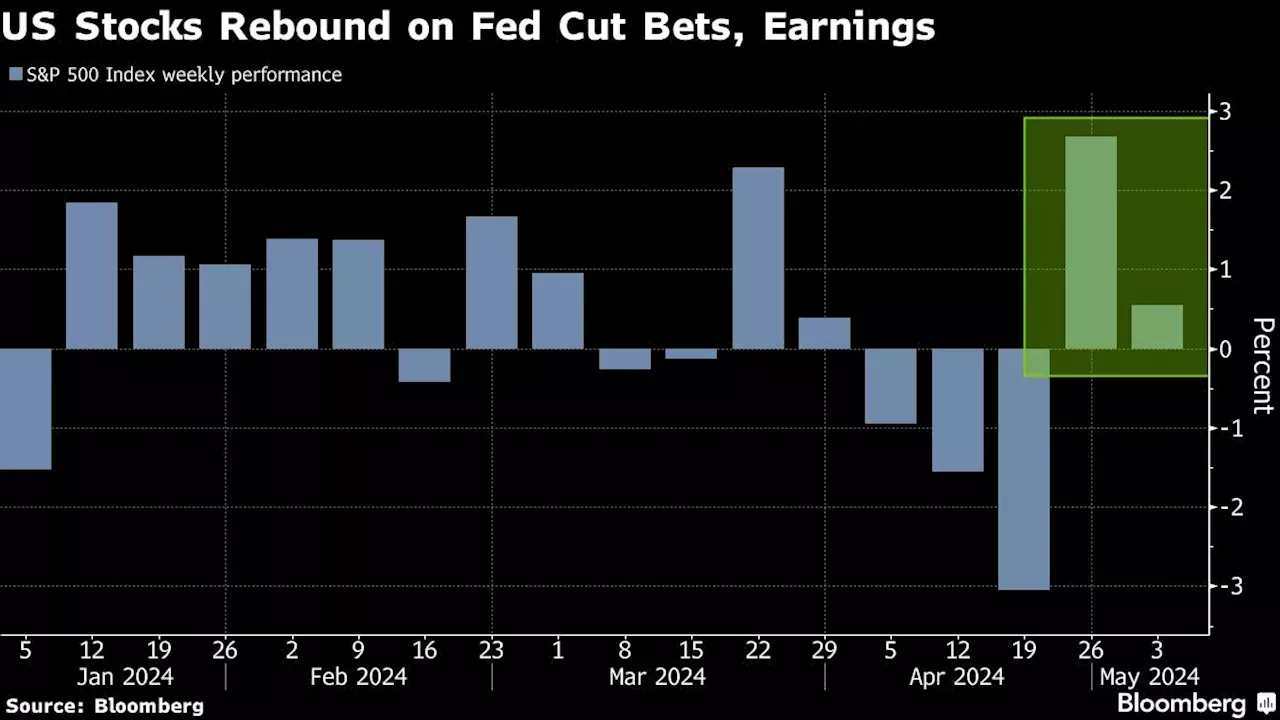

“The price reaction on the back of this release may be more important than the data itself given how influential price action has been on investor sentiment amid an uncertain macro set up,” Wilson said.The S&P 500 has climbed over the past two weeks amid optimism that Fed easing is still likely this year, with solid corporate earnings supporting sentiment. The US benchmark closed Friday above 5,100 points, about 14% higher than Wilson’s 12-month target of 4,500.

Photo Illustration by The Daily Beast/Getty ImagesSen. Mark Kelly raised the alarm over GOP senate hopeful Kari Lake’s suggestion that voters “strap on a Glock” to prepare for the election season, saying it has the potential to incite violence.“It’s dangerous,” Kelly told Kristen Welker on NBC’s Meet the Press. “What Kari Lake said could result in people getting hurt or killed.” Mark Kelly on Kari Lake's incendiary rhetoric: "Kari Lake has never been elected to anything.

日本 最新ニュース, 日本 見出し

Similar News:他のニュース ソースから収集した、これに似たニュース記事を読むこともできます。

Morgan Stanley Strategists See Inflation as Key for Path of StocksNext week’s US inflation print looms as key for the trajectory of equities and wagers on Federal Reserve interest rate cuts, according to Morgan Stanley strategists.

Morgan Stanley Strategists See Inflation as Key for Path of StocksNext week’s US inflation print looms as key for the trajectory of equities and wagers on Federal Reserve interest rate cuts, according to Morgan Stanley strategists.

続きを読む »