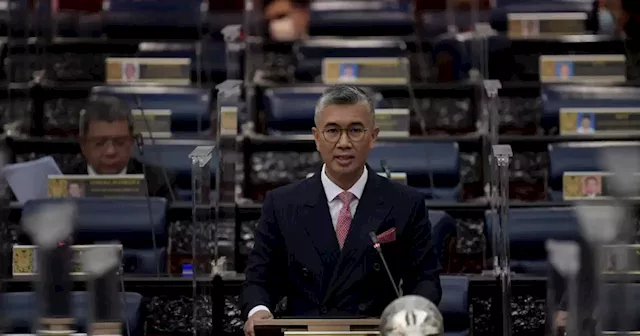

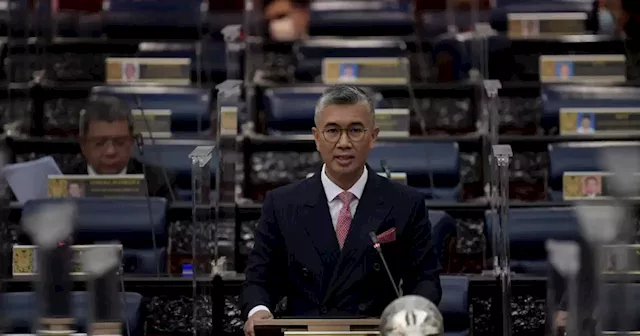

KUALA LUMPUR, March 14 — The negative impact from portfolio balancing by the Employees Provident Fund due to withdrawals by its members has caused the borrowing cost of the government to increase due to added interest payments amounting to RM830 million a year.

Tengku Zafrul said this was because the interest rates of Malaysian Government Securities have increased by an average of 100 basis points compared to the third quarter of 2020. The minister said portfolio balancing by the EPF will give a negative impact on domestic bond and equity markets. Tengku Zafrul said if a one-off withdrawal of RM10,000 is allowed, the number of eligible members who would make withdrawals might reach 6.3 million, involving additional withdrawals of more than RM63 billion.

“This will also affect EPF’s role to provide liquidity for the government bond market where the government’s borrowing cost will rise, and it has risen 100 basis points,” he noted.

It your problem, don’t tell me or ask me to pay for your stupidity…

Menteri overpaid.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Finance Minister: Covid-19 related EPF withdrawals led to lower 2021 conventional savings rate | Malay MailKUALA LUMPUR, Mar 14 — Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz today said that the Employees Provident Fund’s (EPF) 6.1 per cent dividend for conventional savings for 2021 could have been 6.7 per cent if previous unprecedented Covid-19-related withdrawals were not allowed. He said... Terms if withdraw no interest max 10k

Finance Minister: Covid-19 related EPF withdrawals led to lower 2021 conventional savings rate | Malay MailKUALA LUMPUR, Mar 14 — Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz today said that the Employees Provident Fund’s (EPF) 6.1 per cent dividend for conventional savings for 2021 could have been 6.7 per cent if previous unprecedented Covid-19-related withdrawals were not allowed. He said... Terms if withdraw no interest max 10k

더 많은 것을 읽으십시오 »

Finance Minister: Covid-19 related EPF withdrawals led to lower 2021 conventional savings rate | Malay MailKUALA LUMPUR, Mar 14 — Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz today said that the Employees Provident Fund’s (EPF) 6.1 per cent dividend for conventional savings for 2021 could have been 6.7 per cent if previous unprecedented Covid-19-related withdrawals were not allowed. He said... Terms if withdraw no interest max 10k

Finance Minister: Covid-19 related EPF withdrawals led to lower 2021 conventional savings rate | Malay MailKUALA LUMPUR, Mar 14 — Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz today said that the Employees Provident Fund’s (EPF) 6.1 per cent dividend for conventional savings for 2021 could have been 6.7 per cent if previous unprecedented Covid-19-related withdrawals were not allowed. He said... Terms if withdraw no interest max 10k

더 많은 것을 읽으십시오 »