That’s up from $5 billion in 2021.Australia’s mining sector contributes around 13.7% of the country’s GDP and makes up more than two-thirds of Australia’s total merchandise exports. The sector directly employs over a quarter of a million people. This year, the sector has done extremely well despite a sharp slowdown in world economic growth during 2022.

The Department of Industry, Science and Resources, Commonwealth of Australia Resources and Energy’s Quarterly for December 2022 has just been released and showcases this strong performance. The Resources and Energy Quarterly contains the Office of the Chief Economist’s forecasts for the value, volume, and price of Australia’s major resources and energy commodity exports., following high global energy prices and a lower Australian dollar.

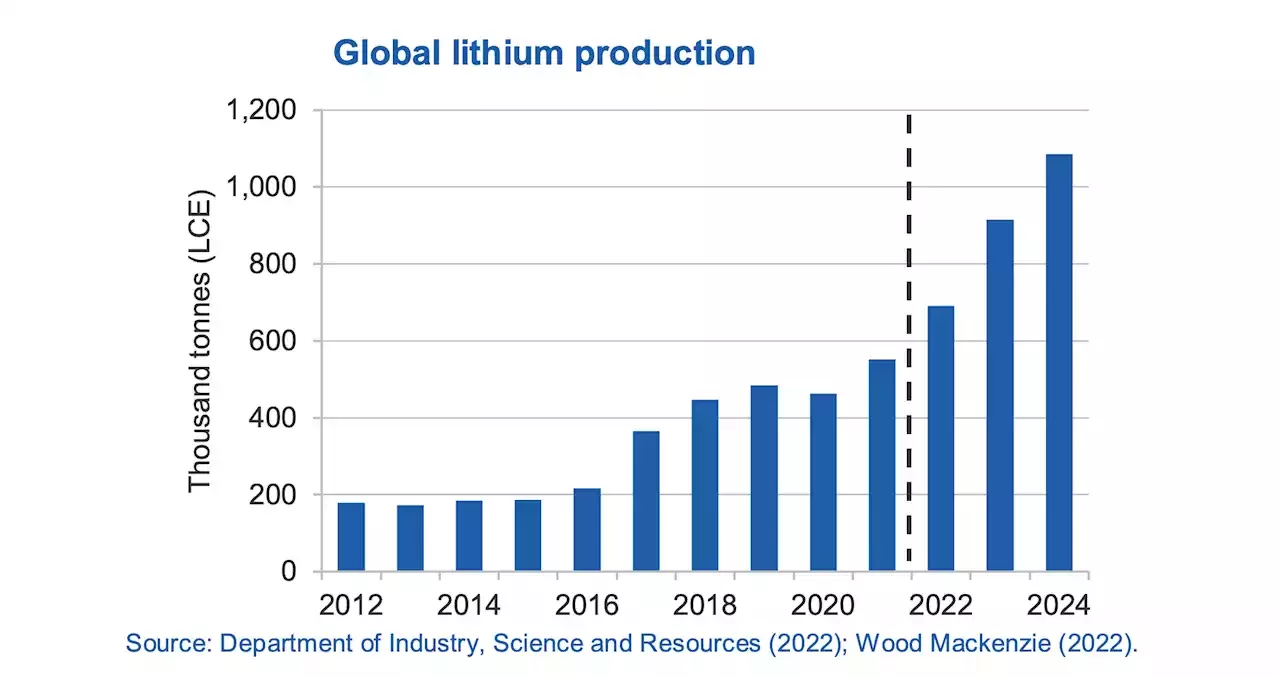

The transition to electric mobility and cleaner sources of energy is expected to supercharge Australia’s mining sector. Australia is already one of the key players for some of the critical elements for making lithium batteries and other key components of the energy transition. Who said there was no demand for electric vehicles? Due to rising demand for batteries for electric vehicles, there has been a boom in the global lithium demand, and Australia is primed to keep benefiting from it.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Inflation, recession and earnings among factors to drive U.S. stocks in 2023U.S. stock investors could not be more eager to turn the page on 2022, a brutal year dominated by market-punishing Federal Reserve rate hikes designed to tamp down the steepest inflation in 40 years. Biden’s policies are ruining the economy. Biden’s been disastrous for the stock market. All this NGO’s Biden brought.. none of these the NGO’s were even discussed before his enemy C student hack became PINO L' idel n'existe pas ;la recession y est ;ses taux differencies montrent comment l'ensemble des mutations arrivent a imposer une transformation en termes monetaires qui demande la realisation de sys/ axes sur une justice reel..

Inflation, recession and earnings among factors to drive U.S. stocks in 2023U.S. stock investors could not be more eager to turn the page on 2022, a brutal year dominated by market-punishing Federal Reserve rate hikes designed to tamp down the steepest inflation in 40 years. Biden’s policies are ruining the economy. Biden’s been disastrous for the stock market. All this NGO’s Biden brought.. none of these the NGO’s were even discussed before his enemy C student hack became PINO L' idel n'existe pas ;la recession y est ;ses taux differencies montrent comment l'ensemble des mutations arrivent a imposer une transformation en termes monetaires qui demande la realisation de sys/ axes sur une justice reel..

더 많은 것을 읽으십시오 »