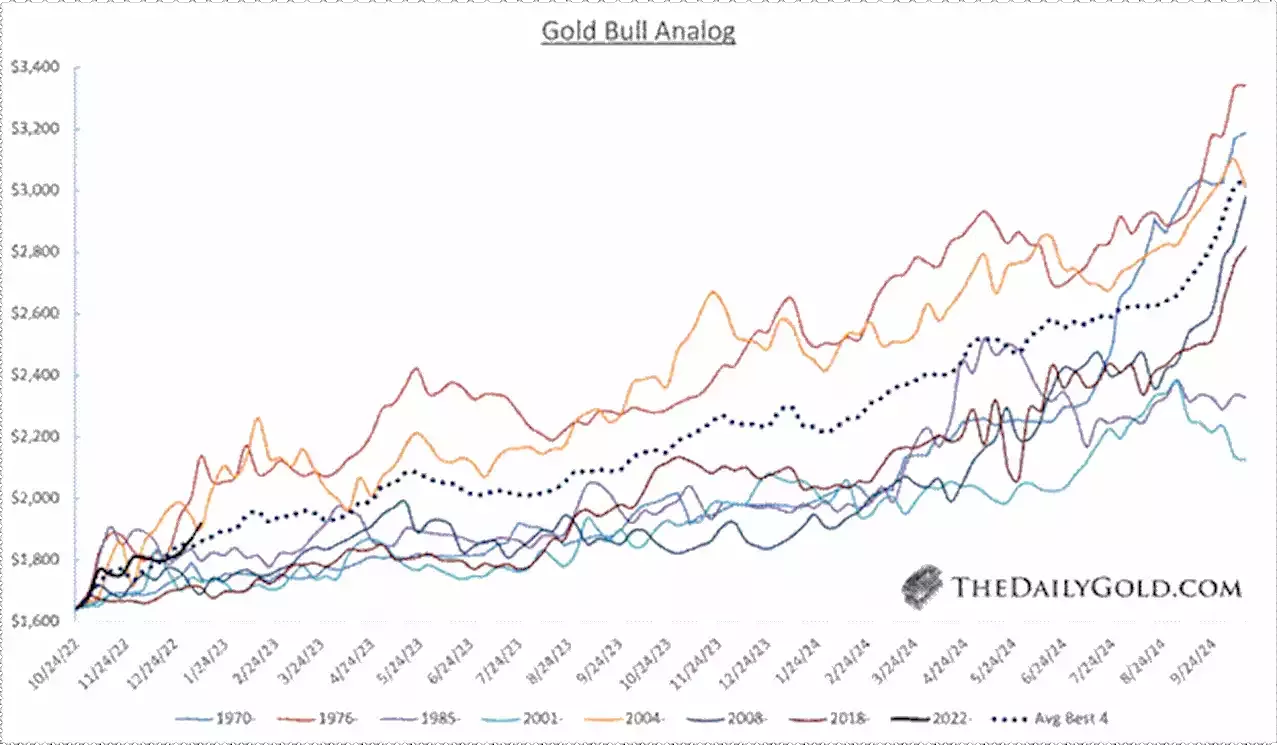

It's always the smart, sensible, but kneejerk posture following a rebound that follows a bear market.But the reality is that Gold and gold stocks do not correct that much until they have already made a big move.Gold rebounded roughly 50% in the seven months following its August 1976 low. During that period, Gold corrected only 5% and 8%. In fact, Gold did not correct more than 12% until two years after that bottom.

Judging from history, even if Gold can reach $2000 or $2050, I would not expect more than an 8% to 10% correction from that point.Unless gold stocks accelerate higher in a vertical fashion, like after the 2008 bottom and after 2001, corrections will be limited to 15% and 20% at the most. From May 2005 to May 2006, GDXJ gained over 150% and endured nothing worse than a 12% correction in closing terms.

Presuming this is a real bull market for precious metals, it is too early to worry about a big correction.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Gold's bull market is just beginning as European fund managers take a bigger stake - HANetfKitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

Gold's bull market is just beginning as European fund managers take a bigger stake - HANetfKitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

더 많은 것을 읽으십시오 »