However, while silver could see further selling pressure in the near term, some analysts said its structural bull market remains intact.

"I think it's more likely we will see $30 in silver before we see $20 in silver, but within that range, there is going to be a lot of volatility," he said. Ghali added that a lot of the weakness in silver is the result of new momentum in the U.S. dollar; however, he said that he sees the U.S. dollar index's push to 102 points as short-lived short covering.

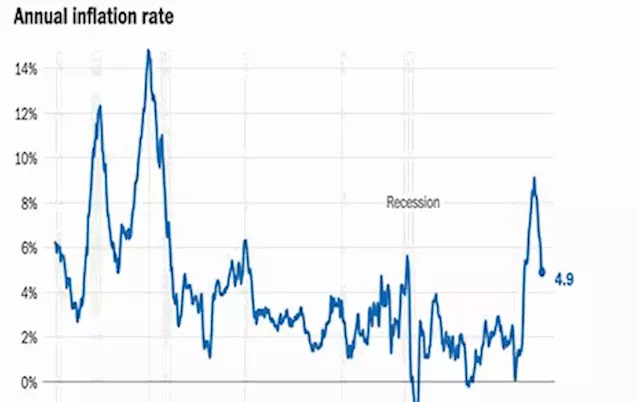

Along with shifting positioning in the U.S. dollar, analysts note that recession fears are causing silver to underperform gold significantly. More than 50% of silver demand comes from industrial applications and can be sensitive to global economic weakness.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Kitco daily macro-economic/business digest - May 10

Kitco daily macro-economic/business digest - May 10

더 많은 것을 읽으십시오 »

Kitco daily macro-economic/business digest - May 11Kitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

Kitco daily macro-economic/business digest - May 11Kitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

더 많은 것을 읽으십시오 »