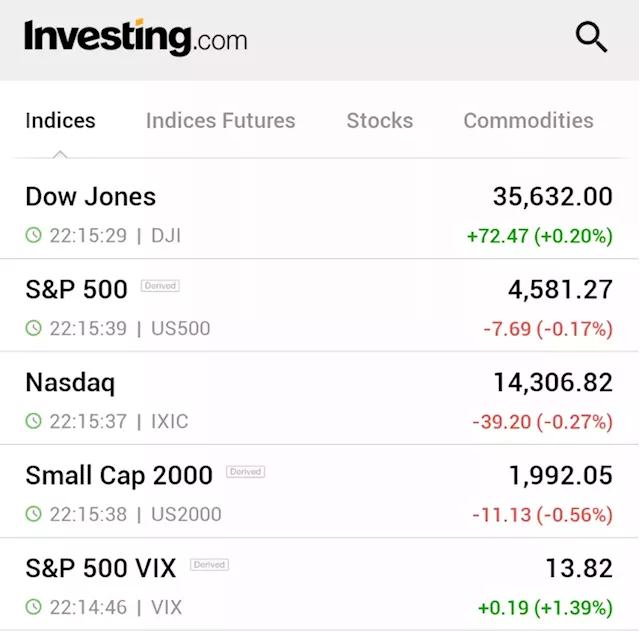

Risk sentiment took a hit after Fitch downgraded the U.S. government’s credit rating to AA+ from AAA late Tuesday, citing likely fiscal deterioration over the next three years and repeated fraught debt ceiling negotiations.

Fitch became the second major rating agency after Standard & Poor’s move to strip the United States of its triple-A rating in 2011, but this decision brought a sharp response from the U.S. government, with Treasury Secretary Janet Yellen calling it"arbitrary and based on outdated data." After the initial losses, “markets will likely see it in a similar way especially in a week full of important data releases and with the next Federal Reserve rate hike hanging in the balance,” said analysts at ING, in a note.Strong earnings have largely helped stocks this reporting season, with around 82% of the S&P 500 companies having reported posting positive surprises, according to FactSet data.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Stock market outlook: New record for S&P 500 'feels inevitable'Why JPMorgan's trading desk says a new record high in the S&P 500 'feels inevitable'

더 많은 것을 읽으십시오 »

U.S. stocks finish higher as S&P 500, Nasdaq climb for 5th straight monthU.S. stocks finished higher on Monday, while the S&P 500 and Nasdaq Composite capped off July by recording their fifth-straight month in the green — the...

U.S. stocks finish higher as S&P 500, Nasdaq climb for 5th straight monthU.S. stocks finished higher on Monday, while the S&P 500 and Nasdaq Composite capped off July by recording their fifth-straight month in the green — the...

더 많은 것을 읽으십시오 »

S&P 500, Nasdaq end lower on first day of August in busy earnings week By Reuters⚠️BREAKING: *S&P 500, NASDAQ START AUGUST LOWER AHEAD OF BUSY EARNINGS WEEK $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

S&P 500, Nasdaq end lower on first day of August in busy earnings week By Reuters⚠️BREAKING: *S&P 500, NASDAQ START AUGUST LOWER AHEAD OF BUSY EARNINGS WEEK $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

더 많은 것을 읽으십시오 »