STORY CONTINUES BELOW THESE SALTWIRE VIDEOSLONDON - Direct lending, a key but expensive source of credit for riskier European firms that banks often shy away from, is running out of steam, a fresh sign that aggressive interest rate rises may be starting to cause funding stress and exacerbate economic pain.The European private credit industry, which flourished after the 2008 financial crisis as capital-constrained banks cut lending, has raised 26.

The European Central Bank has delivered 425 basis points of tightening this economic cycle and the BoE more than 500 bps. Now, those moves are beginning to bite. Deals are"taking longer than they have traditionally", he said, adding Deloitte was seeing an"uptick" in private lenders demanding debt-for-equity swaps, the practice of taking ownership of a business when borrowers struggle to repay debt.

Patrick Marshall, head of fixed income for private markets at Federated Hermes, anticipates tighter liquidity ahead. Faisal Ramzan, a partner at law firm Proskauer Rose who advises private credit funds, said he was not seeing default. But, he added, in the past"three or four months" lenders were starting to"get closer" to companies with weakening prospects to"try and head off anything that's coming down the line".Private credit fund managers express caution about deploying funds in their 300 billion euro market.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

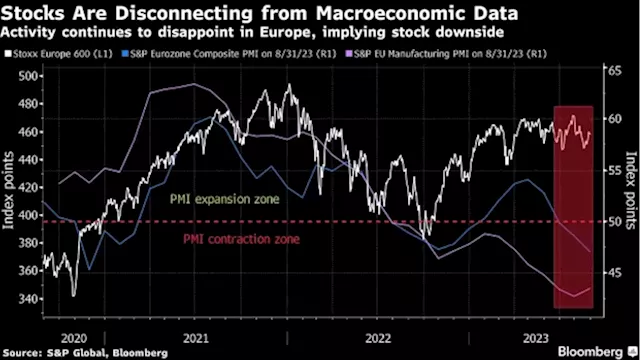

European Stocks Decline as Weak China Data Weighs; Luxury SlidesEuropean equities fell at open on Tuesday as disappointing China data added to concern over the nation’s fragile economic recovery, weighing on stocks strongly exposed to the market.

European Stocks Decline as Weak China Data Weighs; Luxury SlidesEuropean equities fell at open on Tuesday as disappointing China data added to concern over the nation’s fragile economic recovery, weighing on stocks strongly exposed to the market.

더 많은 것을 읽으십시오 »

European Stocks Slip as Weak China Data Weighs on Luxury Sector(Bloomberg) -- European equities were trading slightly lower as disappointing China data dragged down luxury stocks, outweighing a broad rally in the financial sector.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWhy China Is Avoiding Using ‘Bazooka’ to Spur EconomyChina Slowdown Means It May Never Overtake US Economy, Forecast ShowsOpenAI CEO Sam Altman First Person to Get Indonesian Golden VisaThe Stoxx Europe 600 declined 0.2% by 12:16 p.m. in London a

European Stocks Slip as Weak China Data Weighs on Luxury Sector(Bloomberg) -- European equities were trading slightly lower as disappointing China data dragged down luxury stocks, outweighing a broad rally in the financial sector.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWhy China Is Avoiding Using ‘Bazooka’ to Spur EconomyChina Slowdown Means It May Never Overtake US Economy, Forecast ShowsOpenAI CEO Sam Altman First Person to Get Indonesian Golden VisaThe Stoxx Europe 600 declined 0.2% by 12:16 p.m. in London a

더 많은 것을 읽으십시오 »