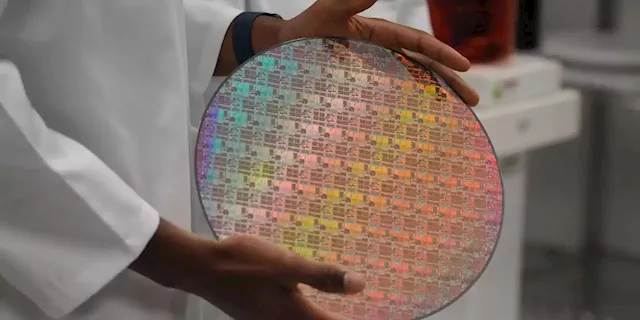

Chip-equipment supplier shares fell Friday following a report that third-party chip fab Taiwan Semiconductor Manufacturing Co. was delaying deliveries to a facility under construction in Arizona because of demand concerns.

Shares of GlobalFoundries GFS, -4.87%, another third-party fab, fell nearly 5%, while Advanced Micro Devices Inc. shares AMD, -4.93% fell 4.3%, and Lattice Semiconductor Corp. LSCC, -5.62% shares fell 4.9%. “We note that equipment makers like Tokyo Electron 8035, +3.11% and Applied Materials have already talked about leading-edge weakness this year offset by mature logic strength,” Malik said in a Friday note. Shares of Tokyo Electron rose more than 3% in Tokyo trade.

Advanced packaging is the industry workaround for the slowing of Moore’s Law, which states the number of transistors on a chip should double every two years, making them faster, smaller and more efficient. Whether the law has been broken is a topic for debate among chip CEOs. While Nvidia Corp.’s NVDA, -3.78% Jensen Huang contends that Moore’s Law is dead, Intel Corp.’s INTC, -2.55% Pat Gelsinger maintains it is still alive.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Chip Stocks Drop After Report Says TSMC Is Concerned About Slowing DemandThe company has told large chip-equipment suppliers to delay some deliveries, according to a new report.

Chip Stocks Drop After Report Says TSMC Is Concerned About Slowing DemandThe company has told large chip-equipment suppliers to delay some deliveries, according to a new report.

더 많은 것을 읽으십시오 »