Hindustan Zinc Ltd. said in a statement that it could create separate legal entities for its zinc & lead, silver, and recycling businesses to help capitalize on “distinct market positions” and attract investors. A committee of directors will evaluate the options and advise the board, along with external advisers.

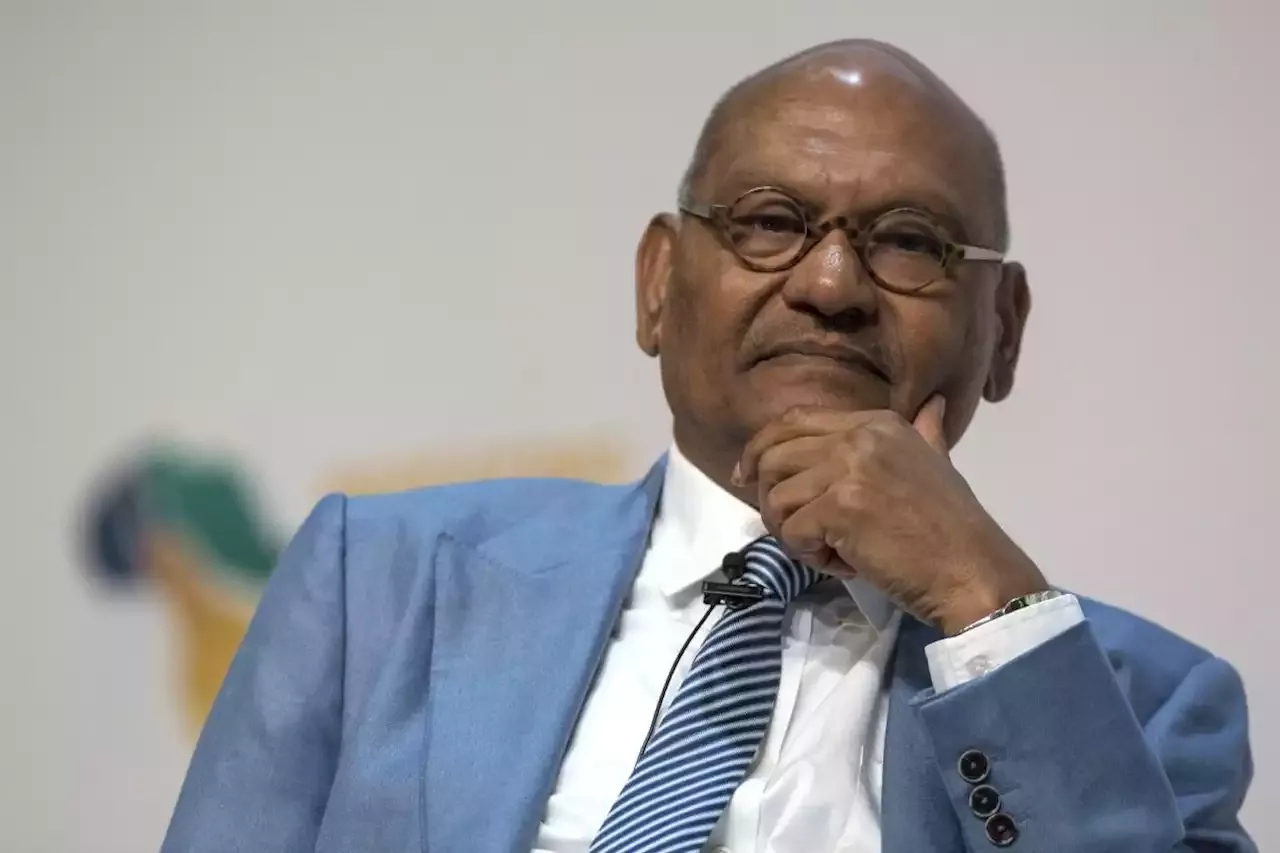

Shares of Vedanta Ltd., which controls the zinc business, jumped as much as 7.9% in Mumbai after the news, while Hindustan Zinc climbed as much as 6.6%. Bloomberg News reported earlier this week that Agarwal’s Vedanta Ltd. was preparing a broad overhaul, with businesses including aluminum, oil and gas, iron ore and steel to be separately listed.“As separate entities, the silver and recycling businesses may fetch better market valuations and as such it could be a win-win for all the stakeholders,” said independent analyst Prashanth Kumar Kota, who has followed the industry for 15 years.

Efforts to simplify a complex financial structure and to reduce a deep conglomerate discount have been floated by the group in the past, including in a video posted in August, but have not previously come to fruition. A heavy debt load has increased the urgency of those plans, though. Vedanta Resources Ltd., the parent of Vedanta Ltd., has $2 billion of bond repayments due in 2024 and another $1.2 billion in 2025.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

IT services provider Kyndryl plans to separate its China business(Reuters) - U.S.-based IT services provider Kyndryl Holdings is planning to split off its China business and has told some employees about the ...

IT services provider Kyndryl plans to separate its China business(Reuters) - U.S.-based IT services provider Kyndryl Holdings is planning to split off its China business and has told some employees about the ...

더 많은 것을 읽으십시오 »