Morocco-born vulture investor Marc Lasry and his sister Sonia Gardner have made billions buying debt and other troubled interest-bearing obligations, such as tax liens. Now they’ve set their sights on sports, looking for value in unexpected places like Major League Pickleball and the NBA’s Africa league.rev in synchrony as they ready for a practice run through the streets of downtown Singapore for September’s annual Grand Prix at Marina Bay Street Circuit.

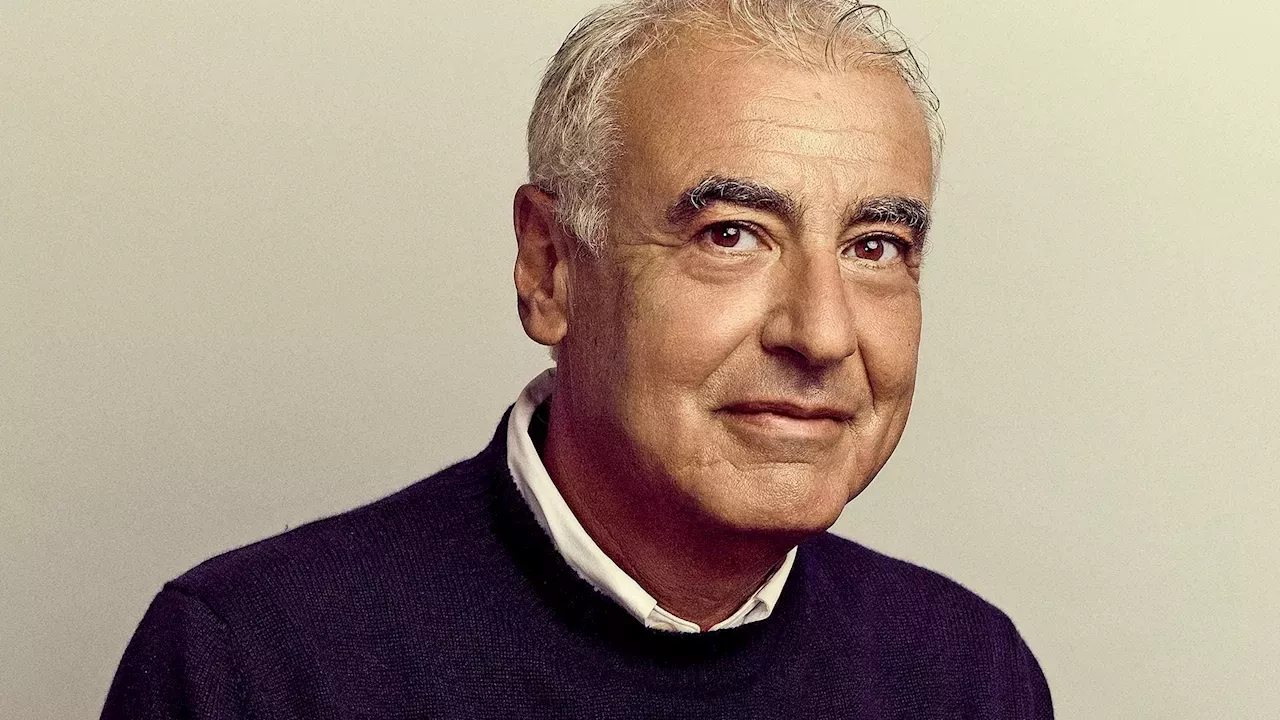

When he bought the franchise in 2014 with another private equity billionaire, Wes Edens , the Bucks were wrapping up a season as the NBA’s worst team.Lasry, 63, and his 61-year-old sister Sonia Gardner are distressed-asset investors, and for most of the last 35 years, bonds and other forms of debt have been their specialty.

Martin Fridson is editor of Forbes/Fridson Income Securities Investor and CIO of Lehmann, Livian, Fridson Advisors LLC. “You really had to have nerves of steel to be investing during that period,” says cofounder Sonia Gardner of Avenue’s buying during the 2008 financial crisis.Marc and Sonia both attended Clark University in Worcester, Massachusetts, from which Marc graduated in 1981 with a B.A. in history. Before attending New York Law School, he worked as a UPS truck driver and briefly considered ditching his academic plans due to the high wages and good benefits.

“Marc has always been focused on investments and the investors. I focus on managing the business day to day,” Gardner says. The formula has worked well. By 2008 Avenue’s assets swelled to $20 billion.