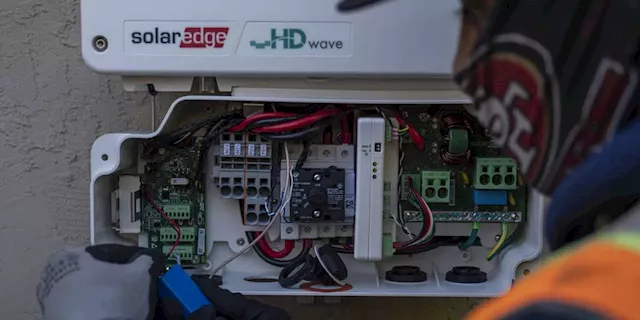

The firm downgraded three solar names to hold from buy: SolarEdge , Sunrun and Sunnova . Deutsche lowered the price target for SolarEdge to $150 — implying a 32% potential upside from the stock's closing price Thursday — from $300. Sunrun's price target was cut to $15, corresponding to a 42% upside, while Sunnova was trimmed to $12.50 — roughly 36% above its previous close.

mountain SEDG, RUN, NOVA YTD chart Analyst Corinne Blanchard cited for the downgrades an overall decline in demand that may not bottom until early 2024 in the U.S. Although she noted that demand remains strong in Northeastern U.S. states, higher interest rates are more likely to impair demand in Southern states, which she wrote "have historically been more focused on loans vs leases" and are likely to still revise numbers downwards.

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Solar Stocks Plunge After Warning on Demand in EuropeSolarEdge Technologies said it encountered 'substantial unexpected cancellations and pushouts of existing backlog' from its European distributors.

Solar Stocks Plunge After Warning on Demand in EuropeSolarEdge Technologies said it encountered 'substantial unexpected cancellations and pushouts of existing backlog' from its European distributors.

출처: MarketWatch - 🏆 3. / 97 더 많은 것을 읽으십시오 »

We're buying up shares of this bank stock on a steep post-earnings pullbackShares of the firm were down roughly 8% in midday trading Wednesday, hitting a new 52-week low.

We're buying up shares of this bank stock on a steep post-earnings pullbackShares of the firm were down roughly 8% in midday trading Wednesday, hitting a new 52-week low.

출처: CNBC - 🏆 12. / 72 더 많은 것을 읽으십시오 »