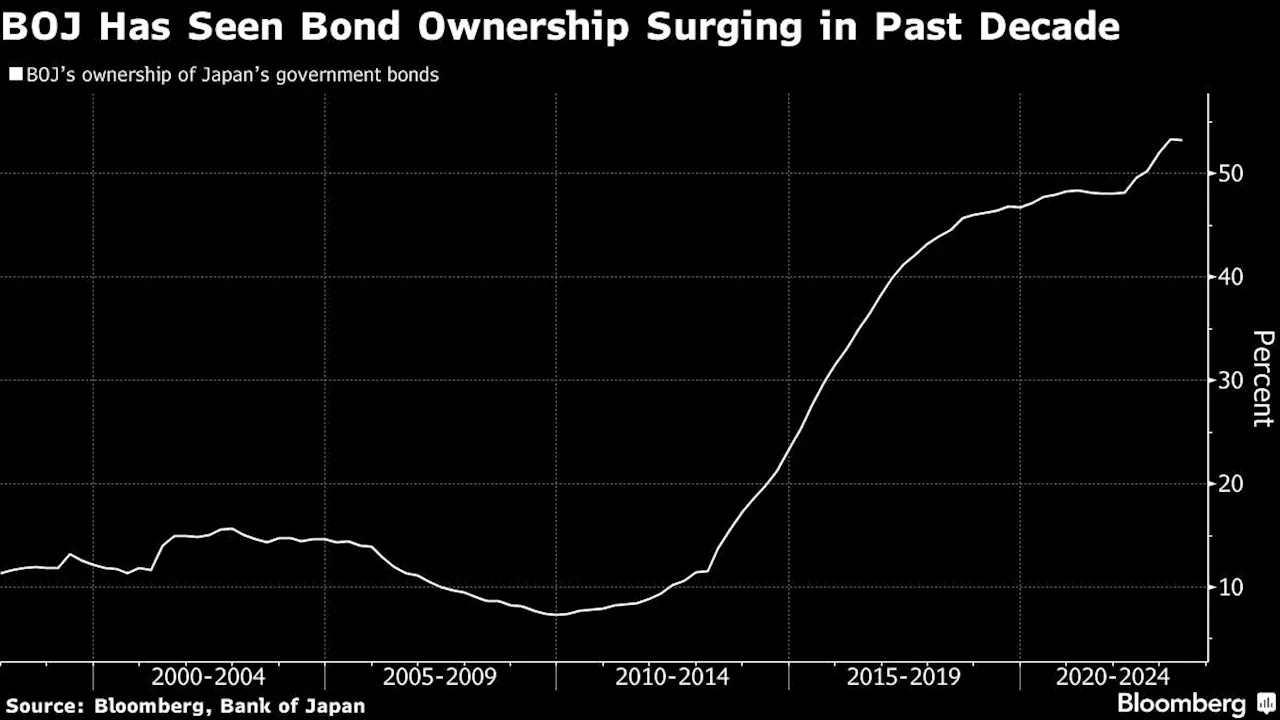

-- The Bank of Japan is bringing an end to its near monopoly of control over the nation’s bond market.Japan’s central bank has tightly overseen the government debt market since it introduced yield-curve control in September 2016, with its ownership of outstanding bonds surpassing 50%. But with the authority now suggesting it’s ready to let the benchmark 10-year yield rise beyond 1%, investors look set to take back the helm.

Signs that the central bank may be moving away from yield-curve control can be seen in its decision to stop conducting unlimited bond-purchase operations every day, and also to no longer show yield levels at which the central bank buys. The operation was initially on an ad-hoc basis until it became daily last year.

The central bank’s presence still remains huge in Japan’s debt market in terms of bond purchases and an unconventional negative-rate policy. But the prospects for elevated inflation for a longer period is likely to fan speculation the BOJ will further normalize policy. Shakedown or smart business? Quebec restaurants balk at hefty penalty for using competitor's payment machines

대한민국 최근 뉴스, 대한민국 헤드 라인

Similar News:다른 뉴스 소스에서 수집한 이와 유사한 뉴스 기사를 읽을 수도 있습니다.

Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, YenThe Bank of Japan’s Kazuo Ueda is in a tight spot. If he stands pat on policy this week he risks sending the yen to a multi-decade low and opening up his yield control program to speculative attack in the market.

Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, YenThe Bank of Japan’s Kazuo Ueda is in a tight spot. If he stands pat on policy this week he risks sending the yen to a multi-decade low and opening up his yield control program to speculative attack in the market.

더 많은 것을 읽으십시오 »

Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, Yen(Bloomberg) -- The Bank of Japan’s Kazuo Ueda is in a tight spot. If he stands pat on policy this week he risks sending the yen to a multi-decade low and...

Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, Yen(Bloomberg) -- The Bank of Japan’s Kazuo Ueda is in a tight spot. If he stands pat on policy this week he risks sending the yen to a multi-decade low and...

더 많은 것을 읽으십시오 »

Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, YenThe Bank of Japan's decision on yields, prices, and the yen poses a market fallout risk for Ueda.

Ueda Faces Market Fallout Risk as BOJ Mulls Yields, Prices, YenThe Bank of Japan's decision on yields, prices, and the yen poses a market fallout risk for Ueda.

더 많은 것을 읽으십시오 »