by 4.3%, and long-dated US Treasuries by 20.4%. In a recent note, a financial research firm outlined four ways investors can gain exposure to rising gold prices.Earlier in 2024, gold prices surged to new record levels, with the yellow metal surpassing $2,400 an ounce last month.

Market participants in China, like their global counterparts, are curious about the drivers of gold-buying activity. This demand is likely due to cultural biases and a lack of trust in local governments, the rule of law, or domestic financial institutions. As a result, gold becomes a natural destination for savings in these economies.

For investors seeking to capitalize on this potential scenario, the financial services firm suggested four ways to gain exposure to rising gold prices.:’ According to Gavekal, these companies tend to offer a lower beta to changes in the gold price and often trade at high valuations.:’ After a decade of underperformance, these stocks are attractively valued and under-owned. However, there are several issues to consider here, as highlighted by Gavekal’s analysts.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Strong Market Breadth Suggests Bull Market Still Has Room to RunStocks Analysis by Investing.com (Calogero Selvaggio) covering: S&P 500, iShares Russell 1000 Growth ETF, iShares Russell 1000 Value ETF, Communication Services Select Sector SPDR® Fund. Read Investing.com (Calogero Selvaggio)'s latest article on Investing.

Strong Market Breadth Suggests Bull Market Still Has Room to RunStocks Analysis by Investing.com (Calogero Selvaggio) covering: S&P 500, iShares Russell 1000 Growth ETF, iShares Russell 1000 Value ETF, Communication Services Select Sector SPDR® Fund. Read Investing.com (Calogero Selvaggio)'s latest article on Investing.

Leer más »

The Mediterranean Gourmet Market (Verified Dupont Beer, Wine, & Gourmet Market) Closed1717 Connecticut Ave, NW The Mediterranean Way Market opened here back in 2013 (changed their name to Verified Dupont Beer, Wine, & Gourmet Market at some point.) Thanks to Andrea for sending: 'The small Italian market (1717 Conn Ave NW) closed up earlier this month.

The Mediterranean Gourmet Market (Verified Dupont Beer, Wine, & Gourmet Market) Closed1717 Connecticut Ave, NW The Mediterranean Way Market opened here back in 2013 (changed their name to Verified Dupont Beer, Wine, & Gourmet Market at some point.) Thanks to Andrea for sending: 'The small Italian market (1717 Conn Ave NW) closed up earlier this month.

Leer más »

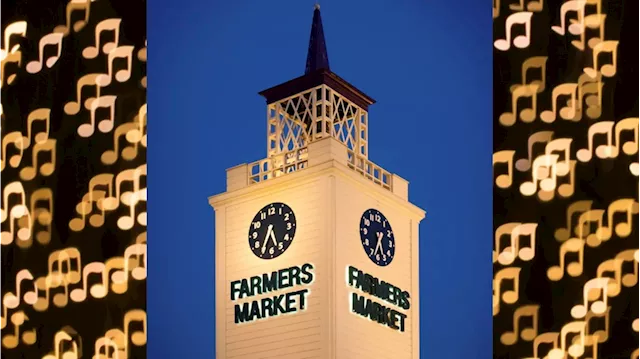

Celebrate the Original Farmers Market's 90th anniversary at a new ‘Night Market'The one-night-only event will include music from the 1990s and a shopping pop-up on the Market Plaza.

Celebrate the Original Farmers Market's 90th anniversary at a new ‘Night Market'The one-night-only event will include music from the 1990s and a shopping pop-up on the Market Plaza.

Leer más »

Crypto market stumbles amid arrest of Samourai Wallet foundersDespite favorable market sentiment, the crypto market briefly fell amid the arrest of Samourai Wallet founders.

Leer más »