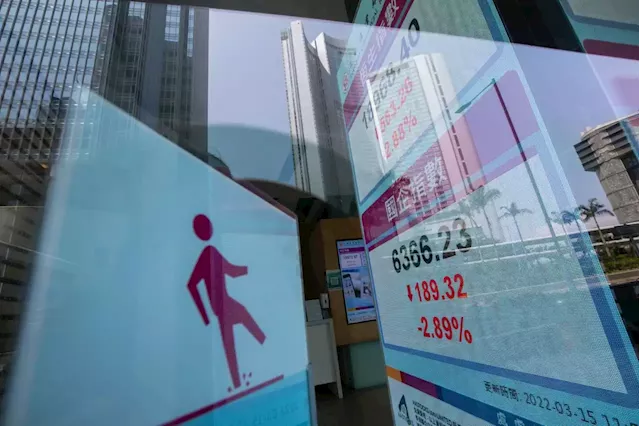

announced on 7 October. Those sweeping sanctions were introduced to keep cutting-edge chip technologies out of reach for China’s military but have amplified uncertainty around its tech industry and wrought havoc on global chip stocks.

A licence is required for US persons – anyone with an American passport, green card or residency – conducting or authorising the delivery of items used to develop or produce advanced chips at a plant in China, but not those who perform related clerical or administrative duties. The same controls apply to US persons who maintain, repair and refurbish those items, according to the document.

Foreign-born designers and engineers, along with Chinese people with overseas passports, have long played an instrumental role in the nation’s technological development. The new curbs triggered widespread concern in the country’s chip industry that US staff would be completely sidelined. Several major Chinese semiconductor firms rely on US passport holders for their top management, Bloomberg News has reported.

Chinese chipmakers like Semiconductor Manufacturing International or machinery suppliers such as Naura Technology Group may still be affected, but the measures will only prevent people from performing certain functions. US personnel affiliated with China’s fast-growing chip design sector may end up unaffected – semiconductor design firms generally do not run plants or own much machinery directly.

The new US measures have brought sizable impact to the $550-billion global chip industry that’s already being squeezed by an economic downturn. Companies like Dutch chip equipment maker ASML Holding NV have now

Malaysia Malaysia Latest News, Malaysia Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Business Maverick: Asian stocks gain on earnings optimism, yen drops: markets wrapAsian stocks rise, tracking Friday’s gains in the US, with optimism over corporate earnings helping to drive an advance in Japan. The dollar climbed as traders started to position for a policy decision by the Federal Reserve.

Business Maverick: Asian stocks gain on earnings optimism, yen drops: markets wrapAsian stocks rise, tracking Friday’s gains in the US, with optimism over corporate earnings helping to drive an advance in Japan. The dollar climbed as traders started to position for a policy decision by the Federal Reserve.

Read more »

Business Maverick: Sunak faces dose of reality as economic and political woes mountRishi Sunak won an endorsement from financial markets in his first days as prime minister, and even some favourable polling numbers from the British public. His first full week in power may be more challenging.

Business Maverick: Sunak faces dose of reality as economic and political woes mountRishi Sunak won an endorsement from financial markets in his first days as prime minister, and even some favourable polling numbers from the British public. His first full week in power may be more challenging.

Read more »

Business Maverick: Markets wrap: stocks advance in Asia before rate-hike decisionsStocks advanced during the Asian trading session amid higher bond yields and investor focus on central bank decisions and the pace of further interest rate hikes.

Business Maverick: Markets wrap: stocks advance in Asia before rate-hike decisionsStocks advanced during the Asian trading session amid higher bond yields and investor focus on central bank decisions and the pace of further interest rate hikes.

Read more »

Business Maverick: Wheat soars after Russia exits pact allowing Ukraine exportsWheat futures surged after Russia pulled out of an agreement to allow grain exports from Ukraine through the Black Sea, a deal seen as critical for easing tight world supplies and controlling global food costs. How are sanctions working out for you?

Business Maverick: Wheat soars after Russia exits pact allowing Ukraine exportsWheat futures surged after Russia pulled out of an agreement to allow grain exports from Ukraine through the Black Sea, a deal seen as critical for easing tight world supplies and controlling global food costs. How are sanctions working out for you?

Read more »

Business Maverick: Tech Leads Stocks Lower as Yields Rise on Fed Week: Markets WrapStocks fell at the start of a busy week for corporate earnings, with investors awaiting Wednesday’s Federal Reserve decision for clues on whether officials will dial back the pace of rate increases as early as December.

Business Maverick: Tech Leads Stocks Lower as Yields Rise on Fed Week: Markets WrapStocks fell at the start of a busy week for corporate earnings, with investors awaiting Wednesday’s Federal Reserve decision for clues on whether officials will dial back the pace of rate increases as early as December.

Read more »