-- Under Prime Minister Narendra Modi, India’s stocks have commanded an unprecedented premium to emerging-market peers. As he seeks a third successive term, investors are betting that the performance can continue.Texas Warns of Possible Power Emergency Next Week

In 2019, the alliance led by the BJP won more than 350 of the 543 seats in the lower house of Parliament.“Modi has unlocked India’s potential,” said Mike Sell, head of global emerging equities at Alquity Investment Management Ltd. “Investors prefer stability and clarity. A majority government versus an unwieldy coalition would certainly be preferable.

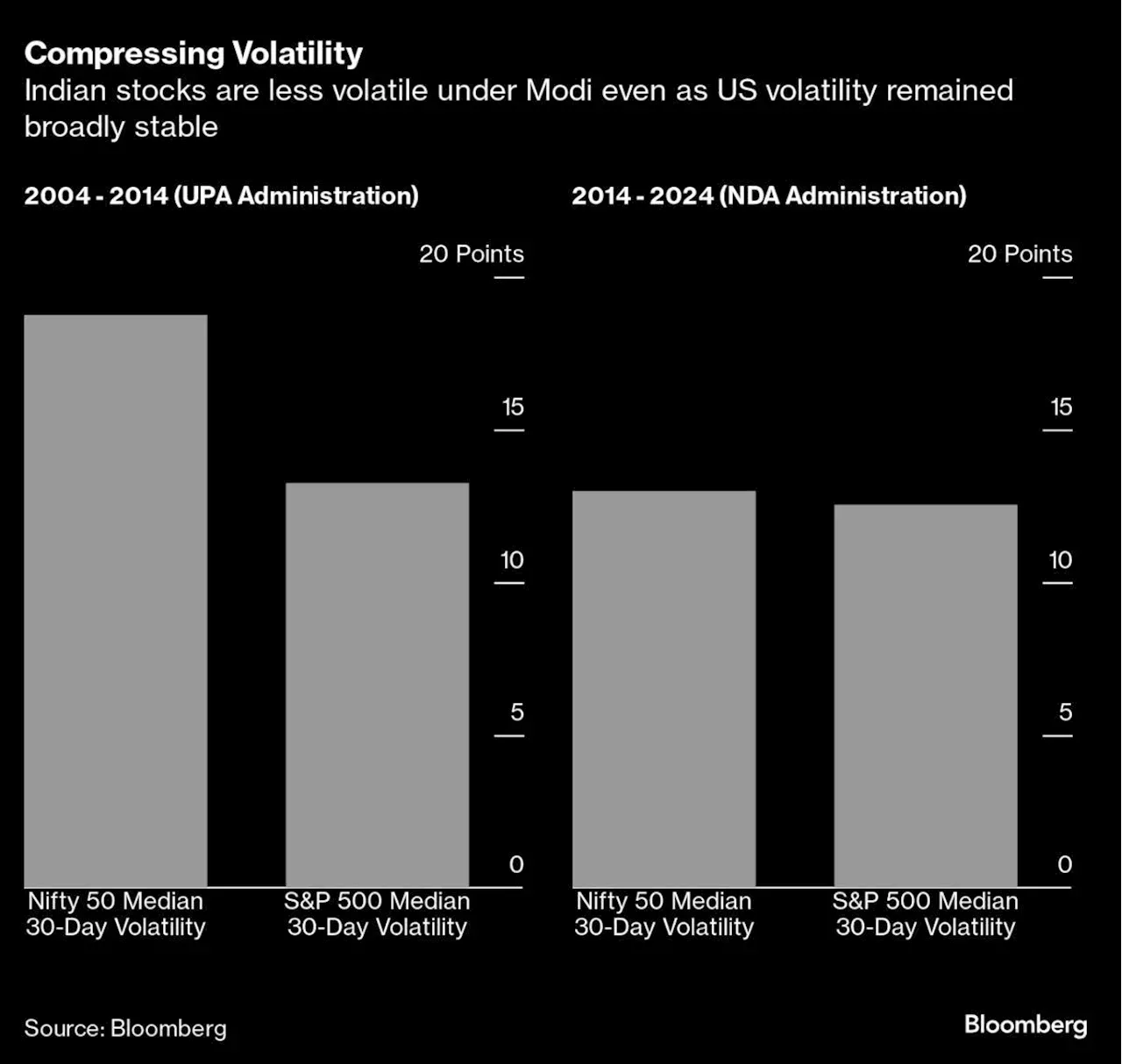

Investor confidence in Indian markets still seems to have grown under Modi, with volatility plummeting across asset classes. For stocks, the median 30-day volatility in the benchmark NSE Nifty 50 Index dropped to 13 points over the last decade, from 18.5 points in the previous comparable period, data compiled by Bloomberg show.

Currency stability in turn has boosted the attractiveness of the nation’s sovereign debt for foreign investors, with Indian bonds seeing the longest monthly streak of inflows in almost a decade ahead of their inclusion in major global bond indexes.

Nederland Laatste Nieuws, Nederland Headlines

Similar News:Je kunt ook nieuwsberichten lezen die vergelijkbaar zijn met deze die we uit andere nieuwsbronnen hebben verzameld.

Emerging-Market Bulls Tout Modi Premium as Indian Election NearsUnder Prime Minister Narendra Modi, India’s stocks have commanded an unprecedented premium to emerging-market peers. As he seeks a third successive term, investors are betting that the performance can continue.

Emerging-Market Bulls Tout Modi Premium as Indian Election NearsUnder Prime Minister Narendra Modi, India’s stocks have commanded an unprecedented premium to emerging-market peers. As he seeks a third successive term, investors are betting that the performance can continue.

Bron: BNNBloomberg - 🏆 83. / 50 Lees verder »

Colombia Returns to Bond Market in Test for EM Junk AppetiteColombia returned to the bond market, testing investor appetite for emerging market junk bonds.

Colombia Returns to Bond Market in Test for EM Junk AppetiteColombia returned to the bond market, testing investor appetite for emerging market junk bonds.

Bron: BNNBloomberg - 🏆 83. / 50 Lees verder »

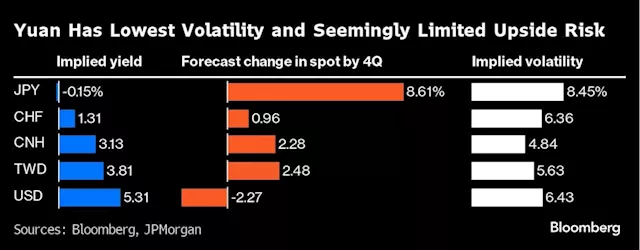

China’s Yuan Standout Funder for Emerging-Market Carry Trade(Bloomberg) -- The historic end to super-easy monetary policy in Japan and a surprise rate hike in Taiwan have strengthened the yuan’s appeal as a funding...

China’s Yuan Standout Funder for Emerging-Market Carry Trade(Bloomberg) -- The historic end to super-easy monetary policy in Japan and a surprise rate hike in Taiwan have strengthened the yuan’s appeal as a funding...

Bron: YahooFinanceCA - 🏆 47. / 63 Lees verder »

China’s Yuan a Standout Funder for Emerging-Market Carry TradeThe historic end to super-easy monetary policy in Japan and a surprise rate hike in Taiwan have strengthened the yuan’s appeal as a funding currency for the global emerging-market carry trade.

China’s Yuan a Standout Funder for Emerging-Market Carry TradeThe historic end to super-easy monetary policy in Japan and a surprise rate hike in Taiwan have strengthened the yuan’s appeal as a funding currency for the global emerging-market carry trade.

Bron: BNNBloomberg - 🏆 83. / 50 Lees verder »

Emerging-Market Currencies Hit Two-Month Low on Flight From RiskA gauge of emerging-market currencies dropped to the lowest level in more than two months as rising geopolitical tensions added to an increase in risk aversion amid a shift in the US rate outlook this week.

Emerging-Market Currencies Hit Two-Month Low on Flight From RiskA gauge of emerging-market currencies dropped to the lowest level in more than two months as rising geopolitical tensions added to an increase in risk aversion amid a shift in the US rate outlook this week.

Bron: BNNBloomberg - 🏆 83. / 50 Lees verder »

Emerging-Market Currencies Erase April Gains on South Korea, FedBASF may cut all jobs at battery materials plant over red tape

Emerging-Market Currencies Erase April Gains on South Korea, FedBASF may cut all jobs at battery materials plant over red tape

Bron: BNNBloomberg - 🏆 83. / 50 Lees verder »