Increased liquidity from reactivated coins could lead to short-term volatility and price fluctuationshave recently re-entered circulation, sending ripples through the market. These “lost” coins, once thought to be inaccessible, are now actively circulating again.

The principle of supply and demand dictates that when an asset is scarce, its perceived value increases – especially when demand remains steady or rises. This scarcity narrative has bolstered Bitcoin’s reputation as “digital gold,” a store of value.The reactivation of dormant BTCs, particularly since 2024, marks a shift in Bitcoin’s market dynamics. Around 460,000 BTC, once thought lost, have resurfaced, largely driven by the launch of the Bitcoin ETF.

This influx may temporarily dilute the asset’s perceived scarcity, especially if these coins are sold quickly into the market, potentially creating short-term volatility.value. Although Bitcoin remains limited in total supply, the reactivation of these coins increases the effective circulating supply, changing the balance between supply and demand.

Nederland Laatste Nieuws, Nederland Headlines

Similar News:Je kunt ook nieuwsberichten lezen die vergelijkbaar zijn met deze die we uit andere nieuwsbronnen hebben verzameld.

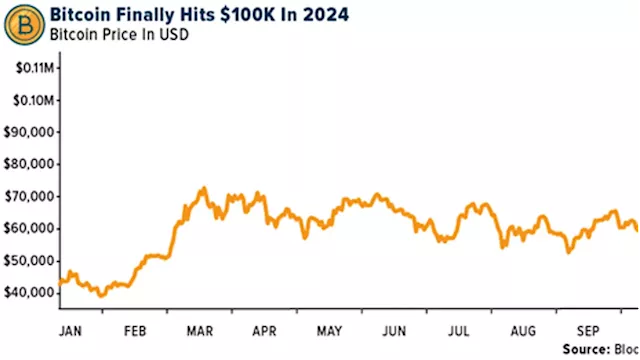

Crypto Market Performance in 2024: Bitcoin's Surge, Altcoin Struggles, and The Halving EffectThis article analyzes the performance of cryptocurrencies in 2024, highlighting Bitcoin's record-breaking surge, the challenges faced by altcoins, and the impact of the Bitcoin halving.

Crypto Market Performance in 2024: Bitcoin's Surge, Altcoin Struggles, and The Halving EffectThis article analyzes the performance of cryptocurrencies in 2024, highlighting Bitcoin's record-breaking surge, the challenges faced by altcoins, and the impact of the Bitcoin halving.

Bron: KitcoNewsNOW - 🏆 13. / 78 Lees verder »