This report is from today's CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe, the sole outlier, fell nearly 2% as the country's 40-year government bond yield rose to 2.766%, its highest on record since 2007, LSEG data showed.was blocked by the White House earlier this month, sources told CNBC's David Faber.

Tech stocks underperformed on Monday as investors took profit on the victors of 2024 and looked for this year's winner.in the S&P last year —slid 3.4%, while Nvidia lost 2%, building upon their losses from last week. Nvidia fell almost 6% during the period, while Palantir lost more than 15%.

Nederland Laatste Nieuws, Nederland Headlines

Similar News:Je kunt ook nieuwsberichten lezen die vergelijkbaar zijn met deze die we uit andere nieuwsbronnen hebben verzameld.

Tech Stocks Retreat as Investors Seek New WinnersAfter a strong 2024, tech stocks took a breather on Monday, with investors booking profits and looking for the next big opportunity. Nvidia and other tech darlings saw their gains from last year start to unwind, while investors rotated into more defensive sectors like consumer staples and healthcare. This rotation, however, is seen as a short-term phenomenon, with the long-term outlook for tech and AI still positive. Meanwhile, news from the business world includes Nippon Steel's failed bid for U.S. Steel and softening inflation in India, which could pave the way for interest rate cuts.

Tech Stocks Retreat as Investors Seek New WinnersAfter a strong 2024, tech stocks took a breather on Monday, with investors booking profits and looking for the next big opportunity. Nvidia and other tech darlings saw their gains from last year start to unwind, while investors rotated into more defensive sectors like consumer staples and healthcare. This rotation, however, is seen as a short-term phenomenon, with the long-term outlook for tech and AI still positive. Meanwhile, news from the business world includes Nippon Steel's failed bid for U.S. Steel and softening inflation in India, which could pave the way for interest rate cuts.

Lees verder »

US Stocks Retreat as Investors Await Fed Policy DecisionUS stocks declined on Tuesday, with the Dow experiencing its ninth consecutive session of losses. Investors are cautiously awaiting the Federal Reserve's final policy announcement of the year, following economic data indicating persistent consumer spending. While retail sales exceeded expectations in November, fueled by an increase in vehicle purchases, market focus remains on the Fed's potential actions. A 25 basis point interest rate cut is almost certain, but investors are closely watching the Fed's economic projections and Chair Jerome Powell's comments for clues on future rate cuts and the central bank's stance on inflation.

US Stocks Retreat as Investors Await Fed Policy DecisionUS stocks declined on Tuesday, with the Dow experiencing its ninth consecutive session of losses. Investors are cautiously awaiting the Federal Reserve's final policy announcement of the year, following economic data indicating persistent consumer spending. While retail sales exceeded expectations in November, fueled by an increase in vehicle purchases, market focus remains on the Fed's potential actions. A 25 basis point interest rate cut is almost certain, but investors are closely watching the Fed's economic projections and Chair Jerome Powell's comments for clues on future rate cuts and the central bank's stance on inflation.

Lees verder »

Retail Investors Fuel Record ETF Inflows with Appetite for Volatile Tech Stocks2024 saw record inflows into ETFs, driven by the growing trend of 'retailization' in trading. Retail investors are increasingly turning to ETFs, particularly those offering leverage, to gain exposure to popular tech stocks. Single-stock ETFs have exploded in popularity since their approval in the US, allowing traders to bet on specific companies like Nvidia, Tesla, and Coinbase with amplified returns (or losses).

Retail Investors Fuel Record ETF Inflows with Appetite for Volatile Tech Stocks2024 saw record inflows into ETFs, driven by the growing trend of 'retailization' in trading. Retail investors are increasingly turning to ETFs, particularly those offering leverage, to gain exposure to popular tech stocks. Single-stock ETFs have exploded in popularity since their approval in the US, allowing traders to bet on specific companies like Nvidia, Tesla, and Coinbase with amplified returns (or losses).

Lees verder »

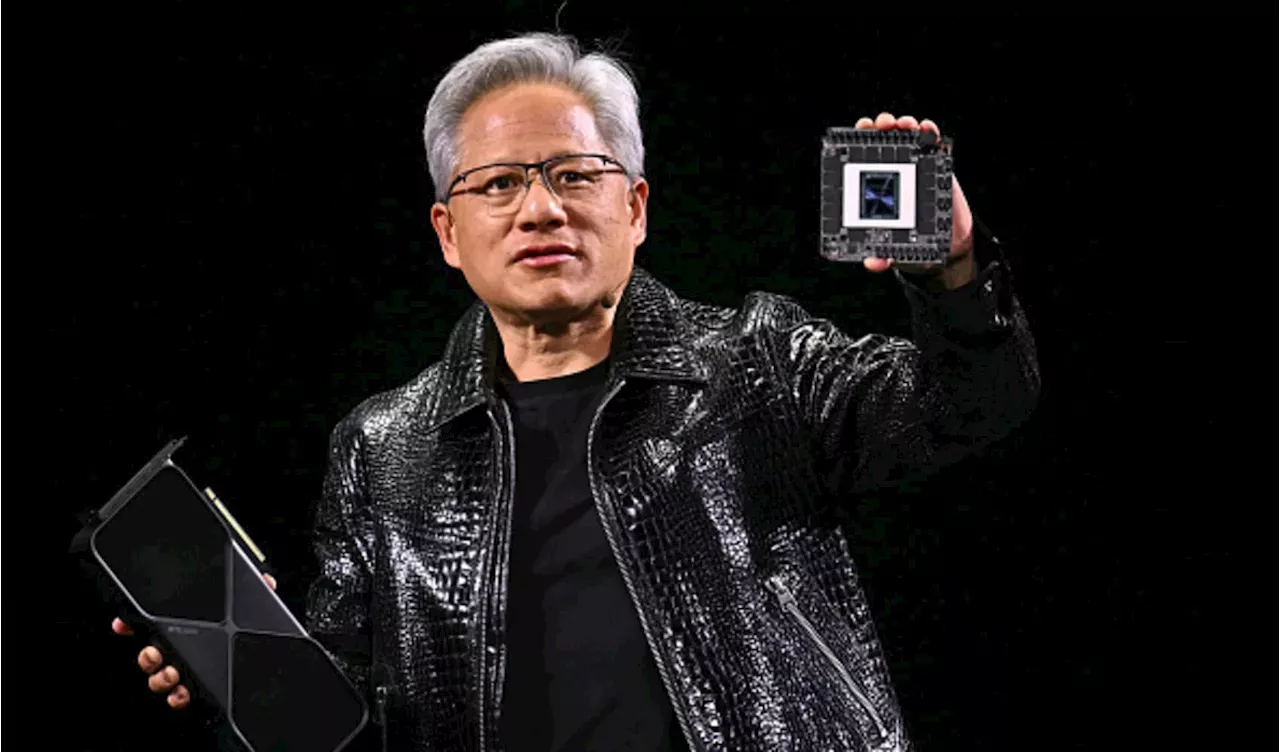

Tech Stocks Correct, Investors Rotate to Energy and IndustrialsAs tech stocks corrected after strong gains in 2024, investors rotated into energy and industrial sectors. Nvidia CEO Jensen Huang delivered a keynote address at CES 2025, highlighting advancements in AI. Meanwhile, the proposed deal between Nippon Steel and U.S. Steel has been blocked by the White House, and India's retail inflation eased to 4.81% in December 2024.

Tech Stocks Correct, Investors Rotate to Energy and IndustrialsAs tech stocks corrected after strong gains in 2024, investors rotated into energy and industrial sectors. Nvidia CEO Jensen Huang delivered a keynote address at CES 2025, highlighting advancements in AI. Meanwhile, the proposed deal between Nippon Steel and U.S. Steel has been blocked by the White House, and India's retail inflation eased to 4.81% in December 2024.

Lees verder »

Tech Stocks Pull Back as Investors Rotate to Other SectorsTech stocks experienced a pullback on Monday as investors took profits from last year's strong performers and sought out new opportunities in other sectors. While the S&P 500 and Dow Jones Industrial Index saw modest gains, Nvidia and Palantir dropped significantly. Experts suggest this rotation is a natural part of the market cycle and that a long-term shift away from tech may not be imminent. However, a rotation within the tech sector, particularly away from AI, cannot be ruled out.

Tech Stocks Pull Back as Investors Rotate to Other SectorsTech stocks experienced a pullback on Monday as investors took profits from last year's strong performers and sought out new opportunities in other sectors. While the S&P 500 and Dow Jones Industrial Index saw modest gains, Nvidia and Palantir dropped significantly. Experts suggest this rotation is a natural part of the market cycle and that a long-term shift away from tech may not be imminent. However, a rotation within the tech sector, particularly away from AI, cannot be ruled out.

Lees verder »

Stock market today: Asian stocks follow Wall Street's retreat, oil prices surgeAsian stocks have retreated after U.S. stocks fell as good news on the job market raised worries over inflation. U.S. futures dropped while oil prices surged more than $1 a barrel. China’s trade surplus expanded for the eighth consecutive year, driven by exports that surged to a record high. The upbeat data failed to boost share prices.

Stock market today: Asian stocks follow Wall Street's retreat, oil prices surgeAsian stocks have retreated after U.S. stocks fell as good news on the job market raised worries over inflation. U.S. futures dropped while oil prices surged more than $1 a barrel. China’s trade surplus expanded for the eighth consecutive year, driven by exports that surged to a record high. The upbeat data failed to boost share prices.

Lees verder »