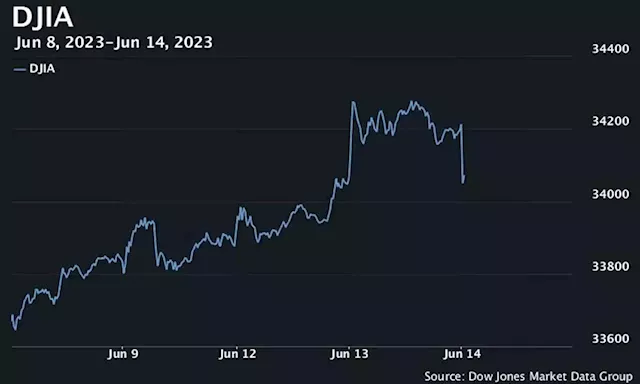

Stocks turned lower Wednesday after the Federal Reserve, as expected, left interest rates unchanged but signaled further increases remain in the pipeline. The Fed’s so-called dot plot showed policy makers expect the central bank to lift rates by another 50 basis points before ending the cycle, a more aggressive outlook than bullish investors appeared to pencil in.

The Dow Jones Industrial Average DJIA, -1.13% fell 363 points, or 1.1%, extending a decline. The S&P 500 SPX, -0.57% gave up a small gain to fall 0.6% while the Nasdaq Composite COMP, -0.62% was down 0.7%. Treasury yields jumped following the data, with the 2-year Treasury yield TMUBMUSD02Y, 4.726%, the most sensitive to policy expectations, jumping 20 basis points to 4.765%, according to FactSet.

Portugal Últimas Notícias, Portugal Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

U.S. stocks open lower as Fed’s rate decision loomsU.S. stocks opened lower Wednesday as investors await the Federal Reserve’s interest-rate decision. The Dow Jones Industrial Average was down 0.5% soon after the opening bell:

U.S. stocks open lower as Fed’s rate decision loomsU.S. stocks opened lower Wednesday as investors await the Federal Reserve’s interest-rate decision. The Dow Jones Industrial Average was down 0.5% soon after the opening bell:

Consulte Mais informação »

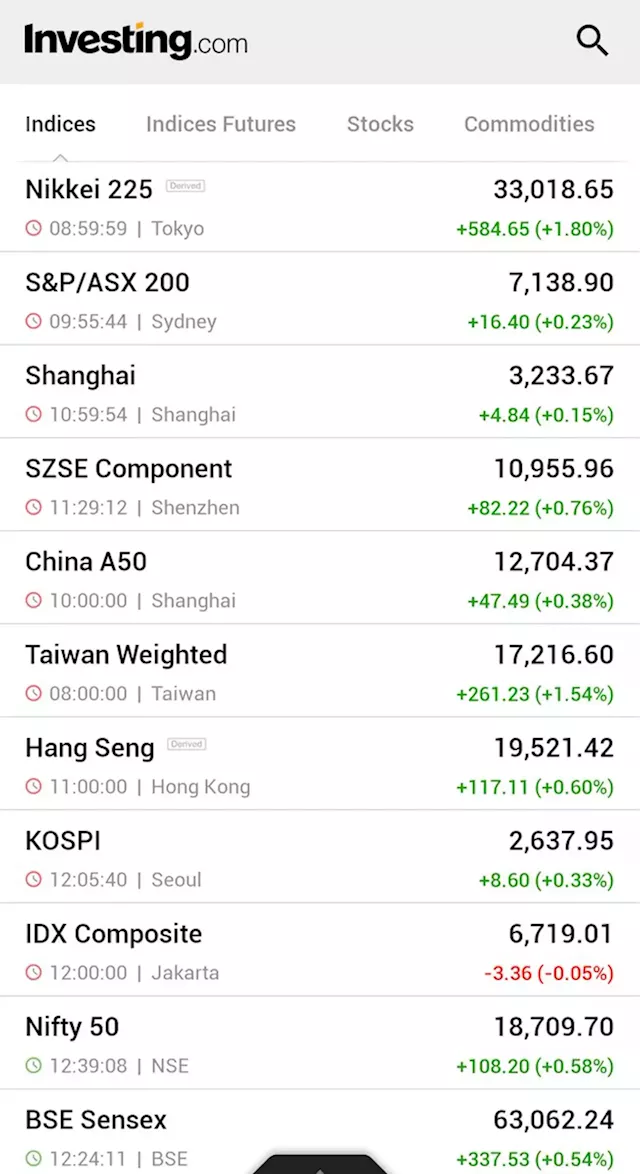

Asian stocks buoyed by chipmakers as Fed, CPI data loom By Investing.com⚠️BREAKING: *ASIA STOCKS END HIGHER AS JAPAN'S NIKKEI CLOSES AT NEW 33-YEAR PEAK 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asian stocks buoyed by chipmakers as Fed, CPI data loom By Investing.com⚠️BREAKING: *ASIA STOCKS END HIGHER AS JAPAN'S NIKKEI CLOSES AT NEW 33-YEAR PEAK 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Consulte Mais informação »

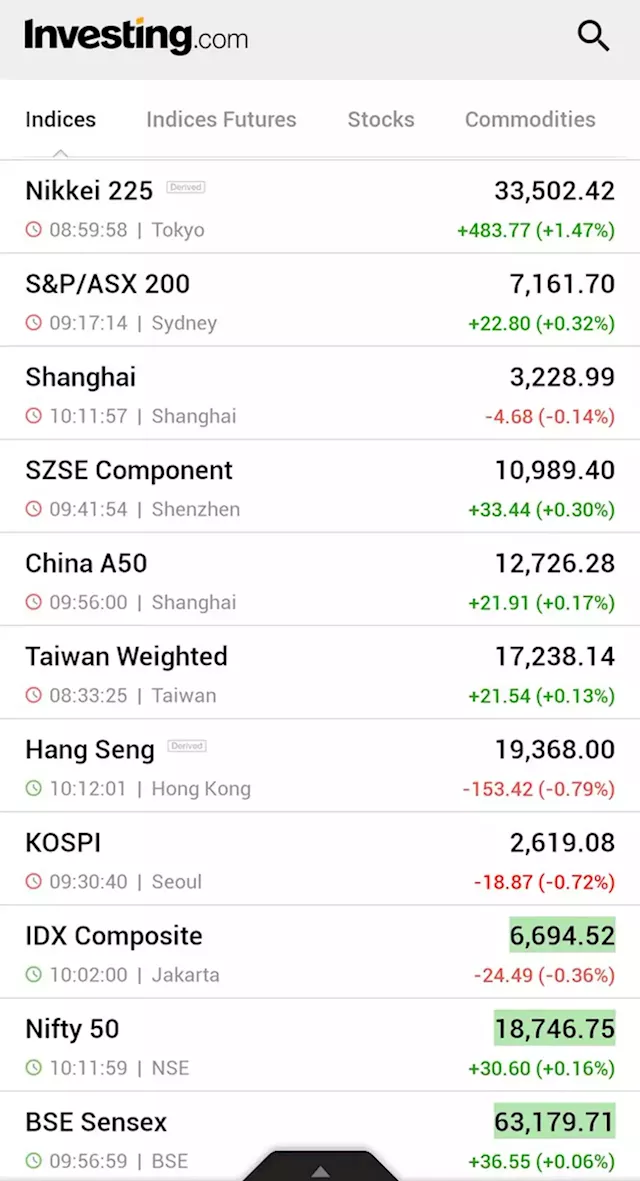

Asian stocks rise on Fed pause bets, Japanese shares at 33-year highs By Investing.com⚠️BREAKING: *ASIA STOCKS RISE ON FED PAUSE BETS, JAPAN'S NIKKEI JUMPS TO ANOTHER 33-YEAR HIGH 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asian stocks rise on Fed pause bets, Japanese shares at 33-year highs By Investing.com⚠️BREAKING: *ASIA STOCKS RISE ON FED PAUSE BETS, JAPAN'S NIKKEI JUMPS TO ANOTHER 33-YEAR HIGH 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Consulte Mais informação »