. Panama-based derivatives platform Deribit, which is among the world’s largest exchanges for crypto options trading volume, told CoinDesk demand is surging ahead of the Merge.Earlier this week, in a disappointing second-quarter earnings report, crypto exchange giant Coinbase evento traders migrating to derivatives-focused platforms as a reason for declining trading volume. Coinbase’s dipping volume led to a 30% decline in the company’s revenues – below most analysts’ estimates.

By comparison, traditional options trading of stocks accounts for 20% of the market cap of the S&P 500 at the Chicago Board Options Exchange , EDG said. “When you think of all the other [S&P 500]-like products including [exchange-traded funds], SP Minis, etc., you can see that bitcoin options have multifold growth ahead of it,” EDG’s quant developer, Marcin Maksymiuk, told CoinDesk.

Delta generates over $200 million in options trading volume per day, and Balani said that “options provide a way for people to get engaged with the market even in a sideways environment.” He foresees options eventually accounting for 60% of the crypto trading market.

mikeybellusci If only I could work with options in my bitfinex but I don't understand complex financial instruments at all

mikeybellusci 👀👀 cega_fi

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

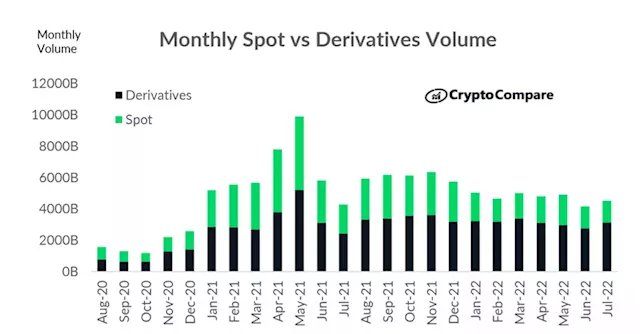

Crypto Derivative Trading Volume Rose for First Time in 4 Months as Market Rallied in JulyWhile leverage boosts returns, it exposes traders to forced liquidations, which inject volatility into the market.

Crypto Derivative Trading Volume Rose for First Time in 4 Months as Market Rallied in JulyWhile leverage boosts returns, it exposes traders to forced liquidations, which inject volatility into the market.

Прочитайте больше »