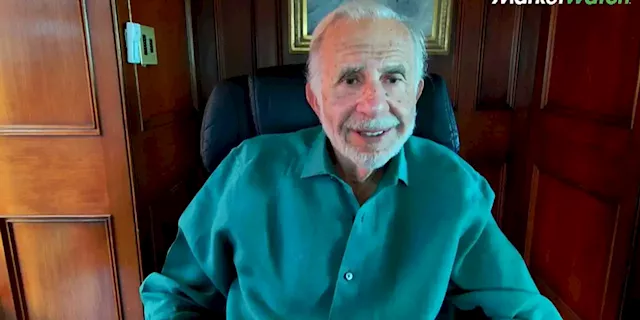

Carl Icahn’s investment arm disclosed a federal investigation of its business on Wednesday, just weeks after a short-seller report accused it of inflating asset values and wiped $4 billion off its market value in a single day.

“We are cooperating with the request and are providing documents in response to the voluntary request for information,” said the filing. Instead, Icahn Enterprises LP IEP Chief Executive David Willetts made a brief statement addressing the allegations made by Nate Anderson’s Hindenburg Research and said a fuller rebuttal would be published at 11.00 a.m.

Willetts said 90% of net asset values, or NAVs, are based on mark-to-market accounting or are audited by third parties. He said the remaining 10% are valued using historical EBITDA, or earnings before interest, taxes, depreciation and amortization. IEP stock tumbled 16% after it posted a surprise quarterly loss. The stock has lost more than $6 billion since the Hindenburg report was published.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Icahn Enterprises stock slides 9% after company swings to first-quarter lossIcahn Enterprises L.P., the investing arm of billionaire activist investor Carl Icahn, said Wednesday it swung to a loss in the first quarter.

Icahn Enterprises stock slides 9% after company swings to first-quarter lossIcahn Enterprises L.P., the investing arm of billionaire activist investor Carl Icahn, said Wednesday it swung to a loss in the first quarter.

Прочитайте больше »

Palantir stock surges after earnings, but here's where analysts find reason to quibbleWhile shares of Palantir were up premarket, analysts weren't all sold on the results, taking issue with the source of upside and a slowdown on some metrics.

Palantir stock surges after earnings, but here's where analysts find reason to quibbleWhile shares of Palantir were up premarket, analysts weren't all sold on the results, taking issue with the source of upside and a slowdown on some metrics.

Прочитайте больше »