While investors have said policymakers need to do more for equities to see a sustainable rebound, Beijing’s latest measures — including a cut on stamp duty for stock trading and curbs in share selling by major stakeholders — appear to have put a floor under the market for now.

China’s largest banks are preparing to cut interest rates on existing mortgages and deposits, the latest attempt by authorities to arrest a slump in the market and reach the 5% economic growth goal. The largest exchange-traded fund focused on Chinese stocks, Huatai-Pinebridge CSI 300 ETF, has seen a surge in inflow this month, a sign that some investors have been buying the dip and betting on a turnaround.

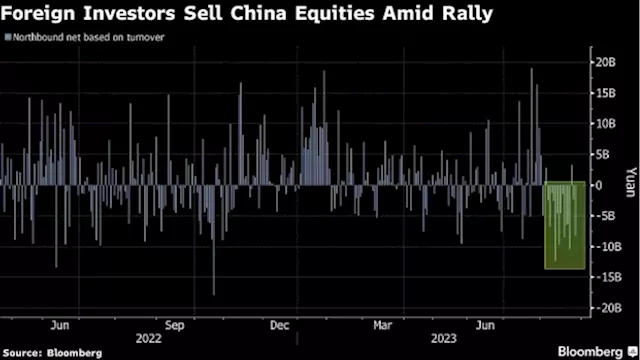

Foreign investors sold 2.5 billion yuan of onshore stocks on a net basis, on track for a record monthly withdrawal.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Chip stocks: Why Secretary Raimondo’s China visit mattersU.S. Commerce Secretary Gina Raimondo visited China this week in a bid to ease some of the tensions between the United States and China. Axios Global Tech Correspondent Ryan Heath joins Yahoo Finance Live to discuss what this means for chipmakers and for the future of U.S. and China relations. Investors and chipmakers should be “mildly encouraged” about communication between the United States and China, Heath says. “The more transparency, the more dialogue, the better for you as a chipmaker,” Heath explains. “U.S. exports to China are still basically at record levels and that also includes for some forms of chips” and the “broad environment is still reasonable encouraging,” Heath notes. Heath says Raimondo 'is extremely well regarded by the White House' and 'is treated as a serious player by the people she is talking to in Beijing, you know, that’s exactly the right person that you want there having these discussions. It doesn’t guarantee any outcomes in the future, but it gives you a solid basis for having a more functional relationship.”

Chip stocks: Why Secretary Raimondo’s China visit mattersU.S. Commerce Secretary Gina Raimondo visited China this week in a bid to ease some of the tensions between the United States and China. Axios Global Tech Correspondent Ryan Heath joins Yahoo Finance Live to discuss what this means for chipmakers and for the future of U.S. and China relations. Investors and chipmakers should be “mildly encouraged” about communication between the United States and China, Heath says. “The more transparency, the more dialogue, the better for you as a chipmaker,” Heath explains. “U.S. exports to China are still basically at record levels and that also includes for some forms of chips” and the “broad environment is still reasonable encouraging,” Heath notes. Heath says Raimondo 'is extremely well regarded by the White House' and 'is treated as a serious player by the people she is talking to in Beijing, you know, that’s exactly the right person that you want there having these discussions. It doesn’t guarantee any outcomes in the future, but it gives you a solid basis for having a more functional relationship.”

Прочитайте больше »

China Asks Some Funds to Avoid Net Equity Sales to Boost MarketChinese authorities asked some mutual funds to avoid selling equities on a net basis a day after financial regulators announced a slew of measures to “invigorate capital markets and boost investor confidence.”

China Asks Some Funds to Avoid Net Equity Sales to Boost MarketChinese authorities asked some mutual funds to avoid selling equities on a net basis a day after financial regulators announced a slew of measures to “invigorate capital markets and boost investor confidence.”

Прочитайте больше »