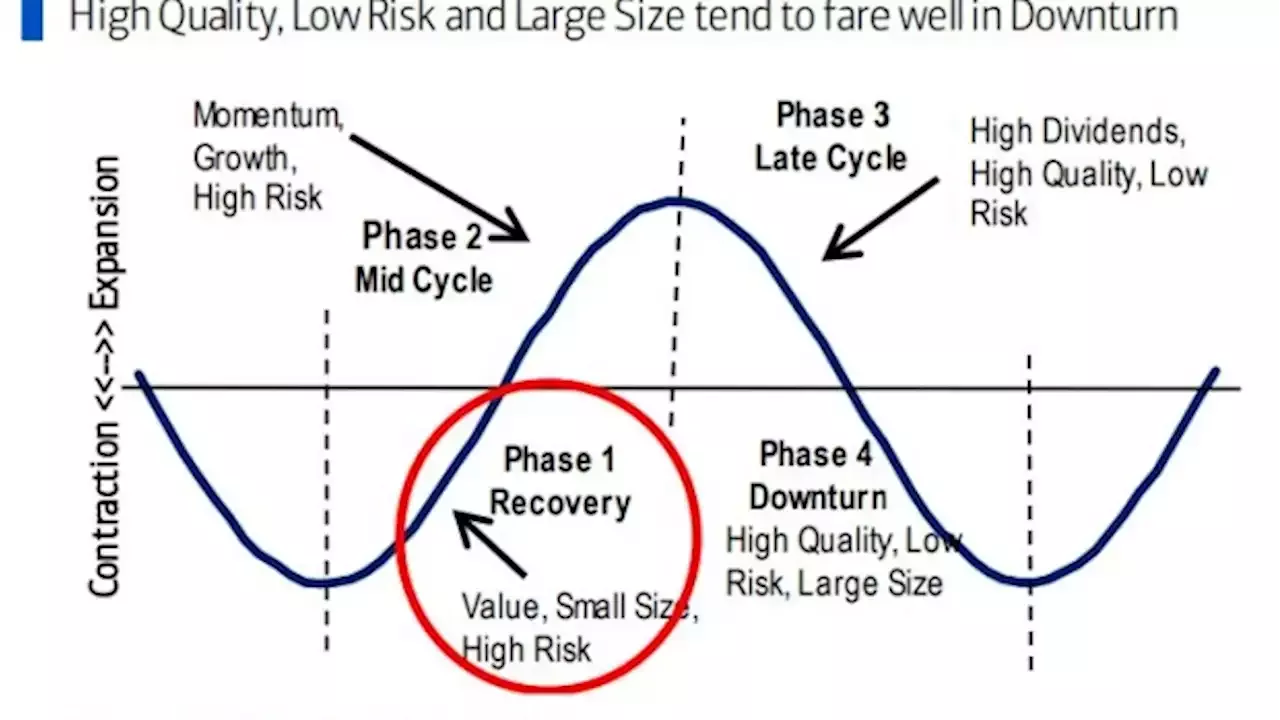

With equities in the “recovery” phase of the business cycle, this year’s laggards — including value and small-capitalization stocks — are primed to outperform, upending the growth, large-cap leadership that has dominated 2023’s bull run, according to strategists led by Savita Subramanian.

Historically, such phases of the cycle have favored financials, industrials, and materials, while utilities, health care and staples have tended to underperform, BofA said. The firm’s model tracks inputs including inflation, gross domestic product forecasts, the 10-year Treasury yield and various manufacturing data.

Bank of America’s view contrasts with that of Morgan Stanley, whose bearish chief US equity strategist Mike Wilson said earlier Monday that investors should focus on a “late-cycle portfolio” of defensive stocks, including industrials, health care and energy. Wilson’s pessimistic view has so far failed to materialize this year after he correctly called 2022’s stock market rout.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Unveiling the Ethereum elite: Top addresses, market cap and price trendsUnveiling Ethereum's elite addresses – Binance and Grayscale dominate, but their combined wealth pales beside ETH's market cap. Will the bear trend persist?

Unveiling the Ethereum elite: Top addresses, market cap and price trendsUnveiling Ethereum's elite addresses – Binance and Grayscale dominate, but their combined wealth pales beside ETH's market cap. Will the bear trend persist?

Прочитайте больше »

Tesla supercomputer could boost EV maker's market cap by $600 billion -Morgan Stanley(Reuters) - Tesla's supercomputer, Dojo, to train AI models for autonomous cars could give the electric vehicle maker an

Tesla supercomputer could boost EV maker's market cap by $600 billion -Morgan Stanley(Reuters) - Tesla's supercomputer, Dojo, to train AI models for autonomous cars could give the electric vehicle maker an

Прочитайте больше »