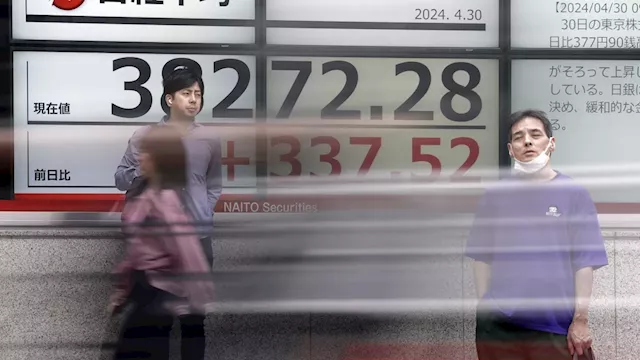

A person looks at an electronic stock board showing Japan’s Nikkei 225 index at a securities firm Thursday, May 2, 2024, in Tokyo. A person stands in front of an electronic stock board showing Japan’s Nikkei 225 index at a securities firm as pedestrians are reflected on a glass window Thursday, May 2, 2024, in Tokyo. A person looks at an electronic stock board showing Japan’s Nikkei 225 index at a securities firm Thursday, May 2, 2024, in Tokyo.

“As expected, Japan’s Ministry of Finance, via the Bank of Japan, was back selling U.S. dollars to stabilize the yen. Indeed, the Japanese government is digging into their sizable 1.2-trillion-USD war chest, looking to take profit on the dollar they bought back in 2000,” Stephen Innes, managing partner at SPI Asset Management, said in a commentary. He said the hope was to stabilize yen around 155-157 to the dollar.

The Dow Jones Industrial Average rose 0.2% to 37,903.29, and the Nasdaq composite lost 0.3% to 15,605.48. At the same time, though, Powell calmed a fear swirling in the market that inflation has remained so high that additional hikes to rates may be necessary.The Fed also offered financial markets some assistance by saying it would slow the pace of how much it’s shrinking its holdings of Treasurys. Such a move could grease the trading wheels in the financial system, offering stability in the bond market.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Stock market today: Asian markets wobble after Fed sticks with current interest ratesAsian markets are wobbling in early trading after U.S. stocks swung to a mixed finish with the Federal Reserve delaying cuts to interest rates.

Stock market today: Asian markets wobble after Fed sticks with current interest ratesAsian markets are wobbling in early trading after U.S. stocks swung to a mixed finish with the Federal Reserve delaying cuts to interest rates.

Прочитайте больше »

Stock market today: Asian shares mostly rise to start a week full of earnings, Fed meetingAsian shares are trading mostly higher as investors kept their eyes on potentially market-moving reports expected later this week. Benchmarks rose Tuesday afternoon in Tokyo, Seoul and Sydney, while edging down slightly in Hong Kong and Shanghai. On Wall Street, the S&P 500 rose 0.3%, the Dow Jones Industrial Average climbed 0.

Stock market today: Asian shares mostly rise to start a week full of earnings, Fed meetingAsian shares are trading mostly higher as investors kept their eyes on potentially market-moving reports expected later this week. Benchmarks rose Tuesday afternoon in Tokyo, Seoul and Sydney, while edging down slightly in Hong Kong and Shanghai. On Wall Street, the S&P 500 rose 0.3%, the Dow Jones Industrial Average climbed 0.

Прочитайте больше »

Stock Market Today: S&P closes lower in wild ride as Fed keeps rate unchangedStock Market Today: S&P closes lower in wild ride as Fed keeps rate unchanged

Stock Market Today: S&P closes lower in wild ride as Fed keeps rate unchangedStock Market Today: S&P closes lower in wild ride as Fed keeps rate unchanged

Прочитайте больше »