BNN Bloomberg's Jon Erlichman looks at how North American markets are shaping up for the trading day.

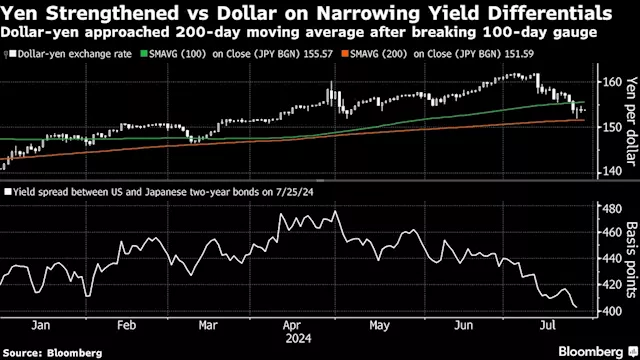

Equities extended their rebound as the panic that recently roiled the financial world subsided. The yen slumped after a BOJ official indicated that policymakers won’t raise rates further if markets are unstable. Treasuries slid, and roughly 15 companies looked to sell U.S. investment-grade debt as borrowers take advantage of a primary market that was left wide open after the global turmoil shut the issuance window.

“Investors are making a more sober assessment of the events over the past week or so,” said Fawad Razaqzada at City Index and Forex.com. “That’s not to say we are completely out of the woods just yet. But there’s at least some stabilisation in the markets, which should allow some markets to re-align with the fundamentals.”

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Japan’s Bank Stocks Climb as BOJ Reported to Consider Rate Hike(Bloomberg) -- Japanese bank stocks rose the most since December 2022 after the nation’s central bank raised its benchmark interest rate and unveiled plans...

Japan’s Bank Stocks Climb as BOJ Reported to Consider Rate Hike(Bloomberg) -- Japanese bank stocks rose the most since December 2022 after the nation’s central bank raised its benchmark interest rate and unveiled plans...

Прочитайте больше »

Asian Stocks Eye Early Gains Into BOJ, Fed Week: Markets Wrap(Bloomberg) -- Asian stocks are poised to rise in early trading ahead of a week of key central bank decisions in Japan, US and UK, as well as some big tech...

Asian Stocks Eye Early Gains Into BOJ, Fed Week: Markets Wrap(Bloomberg) -- Asian stocks are poised to rise in early trading ahead of a week of key central bank decisions in Japan, US and UK, as well as some big tech...

Прочитайте больше »

Japan Stocks Set to Drop Ahead of BOJ Decision: Markets Wrap(Bloomberg) -- Stocks in Japan are set to decline as the nation’s central bank kicks off a closely watched series of global policy meetings. The world’s...

Japan Stocks Set to Drop Ahead of BOJ Decision: Markets Wrap(Bloomberg) -- Stocks in Japan are set to decline as the nation’s central bank kicks off a closely watched series of global policy meetings. The world’s...

Прочитайте больше »