Inflation decelerated in July on a yearly basis to its lowest level since early 2021, a development that could lead the U.S. central bank to slash borrowing costs next month. The move might push mortgage rates lower and give buyers an opening to plunge into the housing market.The Consumer Price Index rose 2.9 percent on a 12-month basis last month, a slight decline from June's 3 percent. The last time CPI was under 3 percent was in March 2021. On a monthly basis, the CPI ticked up 0.

5 percent range, analysts said. Beginning in March 2022, the Federal Reserve hiked its key rate to its current range, helping to push up borrowing costs across the economy, including for home loans.'Price growth has slowed to a level not seen since spring 2021, and today's data is further justification for a September rate cut,' Elizabeth Renter, NerdWallet's senior economist, said in a note shared with Newsweek.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

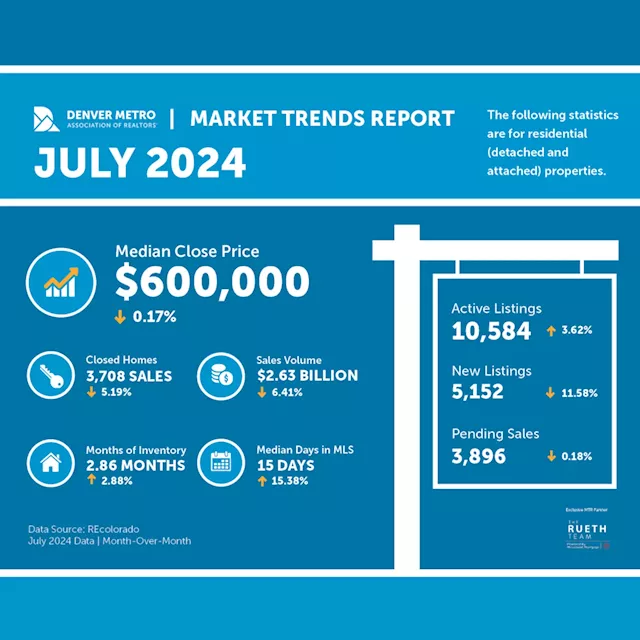

July inventory increase brings Denver housing market closer to a buyer’s marketWith a 68% increase in available inventory from July of last year, the close-price-to-list-price ratio is the lowest it’s been since July 2020. According to the July monthly real estate trend…

July inventory increase brings Denver housing market closer to a buyer’s marketWith a 68% increase in available inventory from July of last year, the close-price-to-list-price ratio is the lowest it’s been since July 2020. According to the July monthly real estate trend…

Прочитайте больше »