this Friday . The central banker is expected to drop clues about the outlook for monetary policy for the rest of the year — clues that are forecast to favor higher bond prices and lower yields.

Fast forward to current conditions and the rally is in full bloom. For a quick recap, let’s start with a broad measure of investment-grade bonds via Vanguard Total Bond Market . The fund has been in a solid uptrend since May and the persistence of the 50-day moving average holding well above its 200-day counterpart suggests that the trend remains resolutely positive.

“I don’t think that the Fed has to fear inflation,” says Tom Porcelli, US chief economist at PGIM Fixed Income. “At this point, it’s right that the Fed is now more focused on labor versus inflation. Their policy is calibrated for inflation that is much higher than this.”Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Bonds Outperform Stocks for the First Time Since April: A Sign of What's to Come?Market Overview Analysis by James Picerno covering: iShares S&P GSCI Commodity-Indexed Trust, Vanguard Total Stock Market Index Fund ETF Shares, Vanguard Real Estate Index Fund ETF Shares, Vanguard Total Bond Market Index Fund ETF Shares. Read James Picerno's latest article on Investing.

Bonds Outperform Stocks for the First Time Since April: A Sign of What's to Come?Market Overview Analysis by James Picerno covering: iShares S&P GSCI Commodity-Indexed Trust, Vanguard Total Stock Market Index Fund ETF Shares, Vanguard Real Estate Index Fund ETF Shares, Vanguard Total Bond Market Index Fund ETF Shares. Read James Picerno's latest article on Investing.

Прочитайте больше »

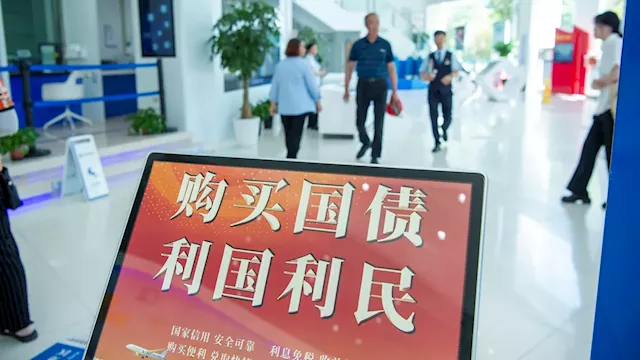

China's bond market is rattled as central bank squares off with bond bullsChina's bond market is on the edge following disruptions as the central bank started intervening heavily to stem a plunge in yields despite a struggling economy.

China's bond market is rattled as central bank squares off with bond bullsChina's bond market is on the edge following disruptions as the central bank started intervening heavily to stem a plunge in yields despite a struggling economy.

Прочитайте больше »

China's bond market rattled as central bank squares off with bond bullsChina's bond market rattled as central bank squares off with bond bulls

China's bond market rattled as central bank squares off with bond bullsChina's bond market rattled as central bank squares off with bond bulls

Прочитайте больше »

Will Global Market Sell-Off Dethrone US Stocks’ 2024 Leadership?Stocks Analysis by James Picerno covering: Vanguard Total Stock Market Index Fund ETF Shares, United States 10-Year, Vanguard Total Bond Market Index Fund ETF Shares. Read James Picerno's latest article on Investing.com

Will Global Market Sell-Off Dethrone US Stocks’ 2024 Leadership?Stocks Analysis by James Picerno covering: Vanguard Total Stock Market Index Fund ETF Shares, United States 10-Year, Vanguard Total Bond Market Index Fund ETF Shares. Read James Picerno's latest article on Investing.com

Прочитайте больше »