--

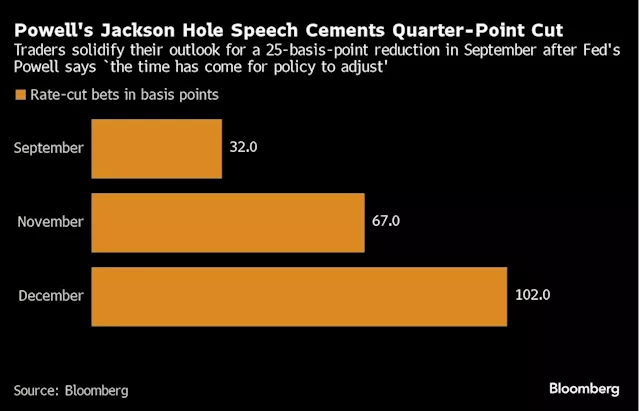

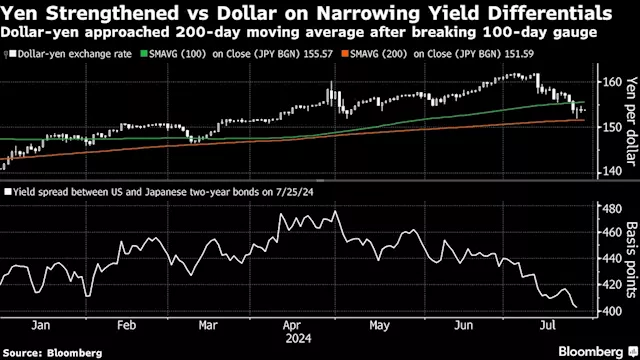

Wall Street kicked off the week resuming a pattern of money rotating into small caps and out of the megacap “safety” after Jerome Powell signalled Friday the central bank will slash borrowing costs in September. U.S. inflation figures this week are expected to reinforce that outlook, with the Fed’s preferred measure of underlying inflation projected to come very close to the two per cent goal.

Fed Bank of Richmond President Thomas Barkin says he still sees upside risks for inflation, though he supports “dialing down” interest rates in the face of a cooling labour market. Orders placed with U.S. factories for business equipment declined in July and the prior month’s gain was revised lower, suggesting firms are more guarded about investment.

The S&P 500 rose 0.2 per cent. The Nasdaq 100 fell 0.2 per cent. The Russell 2000 Index climbed 0.7 per cent. The yield on 10-year Treasuries declined two basis points to 3.78 per cent. Oil advanced after an Israeli strike on Hezbollah targets in southern Lebanon raised tensions in the Middle East and Libya’s eastern government said it will halt exports.• U.S. personal income, spending, PCE; U. Michigan consumer sentiment, Friday• The British pound fell 0.1% to $1.3198• Germany’s 10-year yield was little changed at 2.23%• Spot gold rose 0.5% to $2,524.67 an ounce

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Markets today: Stocks rise on Fed-friendly data as Meta jumps 10%Stocks rose after the latest economic figures signaled further cooling that will be key for the U.S. Federal Reserve to cut interest rates.

Markets today: Stocks rise on Fed-friendly data as Meta jumps 10%Stocks rose after the latest economic figures signaled further cooling that will be key for the U.S. Federal Reserve to cut interest rates.

Прочитайте больше »

Stocks Rally on Fed Cut Hopes, Yen Strengthens: Markets Wrap(Bloomberg) -- Equities in Asia were primed to broadly track US stocks higher Thursday on firming signs the Federal Reserve will soon cut interest rates...

Stocks Rally on Fed Cut Hopes, Yen Strengthens: Markets Wrap(Bloomberg) -- Equities in Asia were primed to broadly track US stocks higher Thursday on firming signs the Federal Reserve will soon cut interest rates...

Прочитайте больше »

Asian Stocks Eye Fed Bounce After Powell Speech: Markets Wrap(Bloomberg) -- Most Asian stocks look poised to gain early Monday, after Wall Street was cheered by signals from Federal Reserve Chair Jerome Powell that US ...

Asian Stocks Eye Fed Bounce After Powell Speech: Markets Wrap(Bloomberg) -- Most Asian stocks look poised to gain early Monday, after Wall Street was cheered by signals from Federal Reserve Chair Jerome Powell that US ...

Прочитайте больше »

Emerging stocks, currencies diverge as markets price U.S. Fed easingThe benchmark indexes for emerging-market equities and currencies, respectively, moved in opposite directions Monday, deepening a trend that emerged last week, when their short-term correlation was interrupted for the first time in 21 years.

Emerging stocks, currencies diverge as markets price U.S. Fed easingThe benchmark indexes for emerging-market equities and currencies, respectively, moved in opposite directions Monday, deepening a trend that emerged last week, when their short-term correlation was interrupted for the first time in 21 years.

Прочитайте больше »

Asian Stocks Eye Early Gains Into BOJ, Fed Week: Markets Wrap(Bloomberg) -- Asian stocks are poised to rise in early trading ahead of a week of key central bank decisions in Japan, US and UK, as well as some big tech...

Asian Stocks Eye Early Gains Into BOJ, Fed Week: Markets Wrap(Bloomberg) -- Asian stocks are poised to rise in early trading ahead of a week of key central bank decisions in Japan, US and UK, as well as some big tech...

Прочитайте больше »

Fed responds to economic data, not politics or stocks, says Chicago Fed's GoolsbeeThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Fed responds to economic data, not politics or stocks, says Chicago Fed's GoolsbeeThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Прочитайте больше »