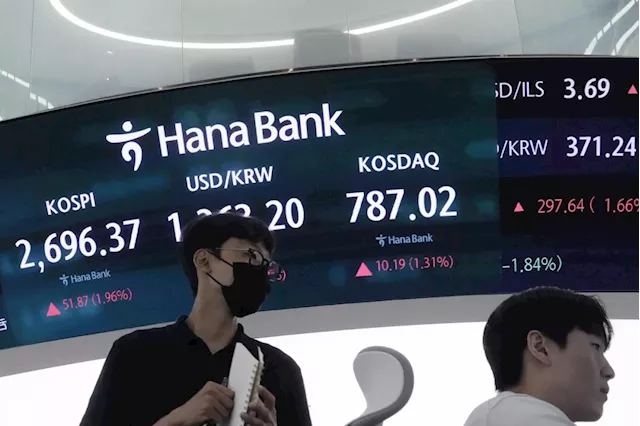

-- Asian equities are poised to come under pressure Tuesday after technology stocks dragged down Wall Street as traders repositioned ahead of Nvidia Corp.’s earnings later this week.With Housing Costs High, Democrats Hone YIMBY Message

Investors continued to keep a close eye on US policymakers as markets monitored the extent to which the Federal Reserve is likely to cut interest rates next month. Fed Bank of San Francisco President Mary Daly said it’s appropriate to begin cutting rates, while her Richmond counterpart Thomas Barkin said he still saw upside risks for inflation, though he supported “dialing down” rates.

“September is historically the worst month on the calendar, so investors should expect some volatility, especially if key indicators like the PCE inflation data, Nvidia earnings, or upcoming payroll disappoint,” he said. In commodities, oil edged lower early Tuesday, following gains on Monday as Libya’s eastern government said it will halt exports. Gold was little changed.The Bloomberg Dollar Spot Index was little changedThe Japanese yen was little changed at 144.46 per dollarDefense Metals Announces CEO and Director Resignations

Police accused Durov of failing to take action against criminal activity on his platform and said that Telegram also failed to cooperate with law enforcement.Francis Ford Coppola Says the Claim He Was Inappropriate on “Megalopolis” Set Is ‘Totally Untrue’Donald Trump was photographed smiling and giving an awkward thumbs up Monday at the graves of fallen marines in Arlington National Cemetery.

Россия Последние новости, Россия Последние новости

Similar News:Вы также можете прочитать подобные новости, которые мы собрали из других источников новостей

Asian stocks mixed after Wall Street rallies as 'time has come' for rate cutsHONG KONG (AP) — Asian stocks were mixed Monday after U.S. stocks rallied close to their records on the expectation the Federal Reserve will start cutting...

Asian stocks mixed after Wall Street rallies as 'time has come' for rate cutsHONG KONG (AP) — Asian stocks were mixed Monday after U.S. stocks rallied close to their records on the expectation the Federal Reserve will start cutting...

Прочитайте больше »

Asian Stocks to Get Boost From Bullish Wall Street: Markets Wrap(Bloomberg) -- Asian stocks are set to gain Tuesday, led by Japan’s benchmark, following a buoyant session on Wall Street where the S&P 500 advanced for an...

Asian Stocks to Get Boost From Bullish Wall Street: Markets Wrap(Bloomberg) -- Asian stocks are set to gain Tuesday, led by Japan’s benchmark, following a buoyant session on Wall Street where the S&P 500 advanced for an...

Прочитайте больше »

Asian stocks are mixed after Wall Street's best week of the yearAsian stocks were mixed Monday as investors ponder the upcoming meeting of the Federal Reserve, following Wall Street's best week since November with a...

Asian stocks are mixed after Wall Street's best week of the yearAsian stocks were mixed Monday as investors ponder the upcoming meeting of the Federal Reserve, following Wall Street's best week since November with a...

Прочитайте больше »

Japan stocks lift Asian market higher after US retail data boosts Wall StreetJapanese stocks led the gains in Asian markets Friday after Wall Street rallied to one of its best days of the year as data showed the U.S. economy is...

Japan stocks lift Asian market higher after US retail data boosts Wall StreetJapanese stocks led the gains in Asian markets Friday after Wall Street rallied to one of its best days of the year as data showed the U.S. economy is...

Прочитайте больше »

Asian Stocks Edge Higher as CPI Calms Wall Street: Markets Wrap(Bloomberg) -- Asian equities rose early Thursday after in-line US inflation data calmed market jitters on Wall Street as traders prepared for Federal...

Asian Stocks Edge Higher as CPI Calms Wall Street: Markets Wrap(Bloomberg) -- Asian equities rose early Thursday after in-line US inflation data calmed market jitters on Wall Street as traders prepared for Federal...

Прочитайте больше »

Asian stocks track Wall Street gains after encouraging US jobs data calm jitters over the economyAsian stocks were higher Friday after U.S. stocks rallied Thursday in Wall Street’s latest sharp swerve after a better-than-expected report on unemployment...

Asian stocks track Wall Street gains after encouraging US jobs data calm jitters over the economyAsian stocks were higher Friday after U.S. stocks rallied Thursday in Wall Street’s latest sharp swerve after a better-than-expected report on unemployment...

Прочитайте больше »