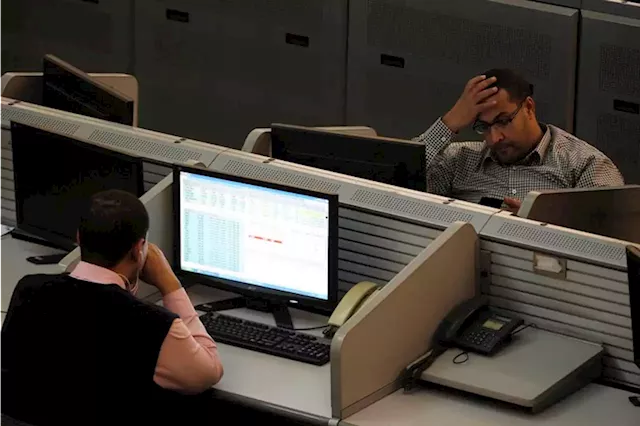

HONG KONG - Asian stocks followed Wall Street's lead on Thursday, dipping across the board as investors interpreted the U.S. Federal Reserve's latest policy statements as signalling higher-for-longer interest rates.

"However, high interest rates will eventually cool the economy, leading to falling yields," he said, adding that they remain constructive on not only long-tenor government bonds or investment grade corporate debt, but also assets like growth and tech stocks.) Global Markets said the overall tone of the Fed's latest meeting was not overly hawkish but there were two surprises.

The U.S. central bank held interest rates on Wednesday and projected an increase by year-end, saying monetary policy is likely to be significantly tighter through 2024 than previously thought.Even as inflation slows for the rest of 2023 and in coming years, the Fed anticipates only modest initial reductions to its policy rate.

المملكة العربية السعودية أحدث الأخبار, المملكة العربية السعودية عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

Stocks gain, US yields fall before likely Fed pause By ReutersStocks gain, US yields fall before likely Fed pause

Stocks gain, US yields fall before likely Fed pause By ReutersStocks gain, US yields fall before likely Fed pause

اقرأ أكثر »

Fed meeting: Dollar climbs, stocks retreat as Fed delivers 'hawkish pause'Follow along to MarketWatch's full coverage of the Federal Reserve interest-rate decision, dot plot, and Jerome Powell press conference.

Fed meeting: Dollar climbs, stocks retreat as Fed delivers 'hawkish pause'Follow along to MarketWatch's full coverage of the Federal Reserve interest-rate decision, dot plot, and Jerome Powell press conference.

اقرأ أكثر »

New marijuana ETF hits the block amid pot stocks rally By ReutersNew marijuana ETF hits the block amid pot stocks rally

New marijuana ETF hits the block amid pot stocks rally By ReutersNew marijuana ETF hits the block amid pot stocks rally

اقرأ أكثر »