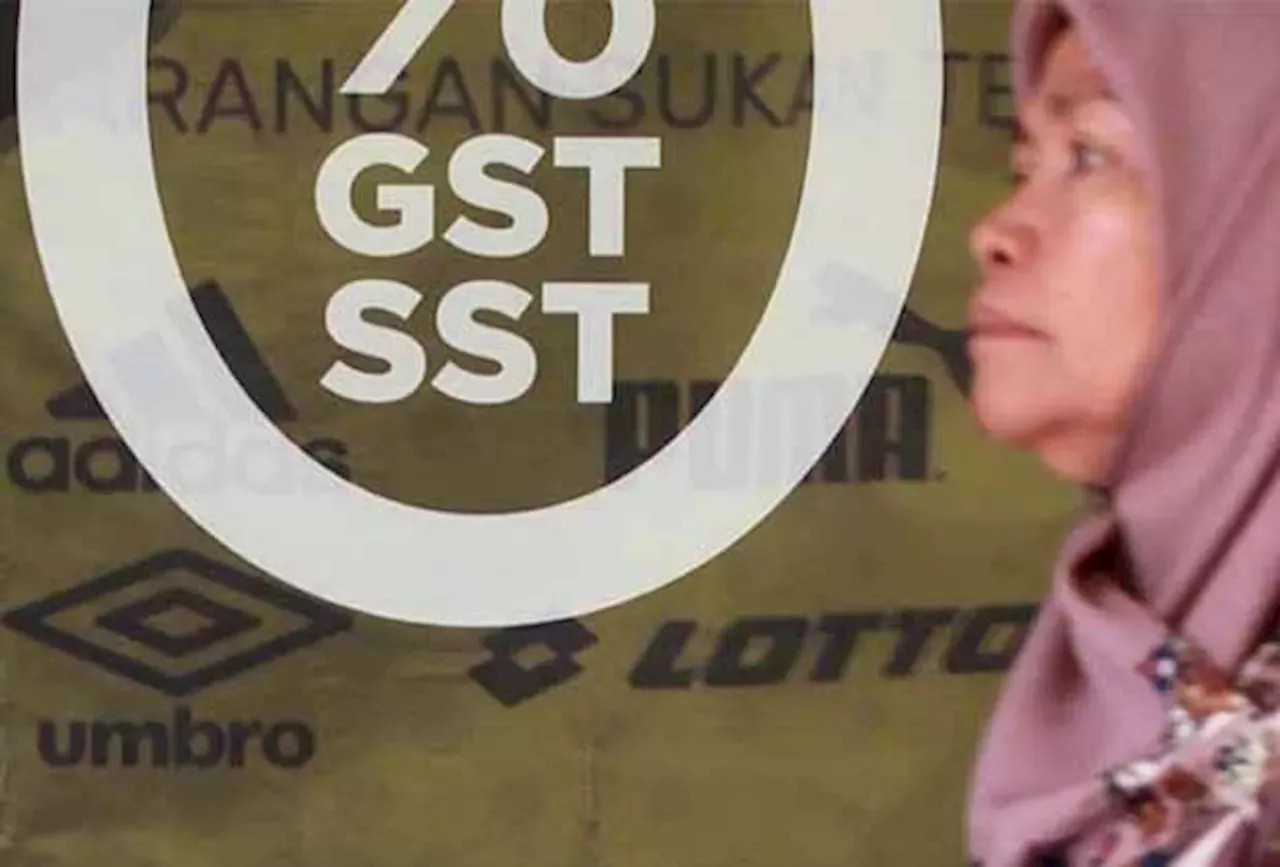

PETALING JAYA: Industry players and stakeholders have called for the proposed High-Value Goods Tax to be scrapped to pave the way for a better and more comprehensive tax system like the Goods and Services Tax .They said the limited revenue to be derived from the HVGT does not warrant its implementation.

Ultimately, consumers may face higher taxes – the multiple tax system would create a negative perception of the country’s economy. “Lawmakers should prioritise public interest over personal pride. Reintroducing the GST should be accompanied by improved mechanisms,” he said.SMS Deen Jewellers chief executive officer Mohamad Shaifudeen Mohamed Sirajudeen said HVGT should not unfairly impact the purchasing patterns of the M40 and B40 groups.

Ng, who is Tomei Consolidated Bhd managing director, said the Customs Department had held several meetings with his company but nothing substantial was achieved with regards to the HVGT.Malay Chamber of Commerce Malaysia president Norsyahrin Hamidon questioned the effectiveness of a multiple tax system for different groups and called for the reintroduction of the GST.

Asked about the government’s reluctance to revert to the GST, Norsyahrin said the onus was on the government to make the right decision, even if it means swallowing a “bitter pill”.

المملكة العربية السعودية أحدث الأخبار, المملكة العربية السعودية عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

Finance Ministry finalising several HVGT policies, says Anwar(Reuters) - Popular messaging platform Telegram raised $330 million through bond sales last week, founder and CEO Pavel Durov said on Monday.

Finance Ministry finalising several HVGT policies, says Anwar(Reuters) - Popular messaging platform Telegram raised $330 million through bond sales last week, founder and CEO Pavel Durov said on Monday.

اقرأ أكثر »