LONDON -The European IPO market is unlikely to see any new candidates until after the summer, as political uncertainty has roiled markets, bankers said.

But several bankers stress the market is not closed for deals, as year to date share sale volumes have staged a recovery. In one example this week, frozen bakery goods company Europastry announced its intention to list in Spain and raise at least 225 million euros. "The recent volatility we have seen around French elections is more likely to affect continental European transactions which are sensitive to the macroeconomic environment, but equally there is a good debate in Europe around pro-growth policies which could benefit investor sentiment," said Alex Watkins, co-head of equity capital markets international at JP Morgan.

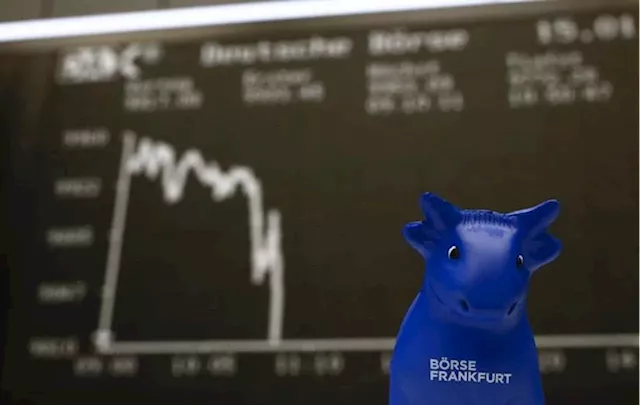

But the shock announcement of a parliamentary election in France which kicks off June 30 caused a spike in volatility and a sell-off in stocks. Last week the Euro STOXX 50 volatility index jumped to its highest level since October. The summer is typically a quieter period for new issues and some bankers have been warning that investors are being selective about the deals they will back.

The U.S. elections in the autumn are also likely to have an impact on the timing of IPOs, but bankers believe investors are less concerned about the potential for market volatility. That could mean a better chance for those companies looking to list from September onwards.

المملكة العربية السعودية أحدث الأخبار, المملكة العربية السعودية عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

European stocks set for muted open after European Central Bank cutEuropean stocks looked set to open relatively flat on Friday, after closing at a record high during the previous session.

European stocks set for muted open after European Central Bank cutEuropean stocks looked set to open relatively flat on Friday, after closing at a record high during the previous session.

اقرأ أكثر »

European stocks set for muted open after European Central Bank cutEuropean stocks looked set to open relatively flat on Friday, after closing at a record high during the previous session.

European stocks set for muted open after European Central Bank cutEuropean stocks looked set to open relatively flat on Friday, after closing at a record high during the previous session.

اقرأ أكثر »

European stocks open marginally higher after European Central Bank cutEuropean stocks opened slightly higher on Friday, after closing at a record high during the previous session.

European stocks open marginally higher after European Central Bank cutEuropean stocks opened slightly higher on Friday, after closing at a record high during the previous session.

اقرأ أكثر »

European stocks lose steam after European Central Bank cutEuropean stocks moved lower on Friday, after closing at a record high during the previous session.

European stocks lose steam after European Central Bank cutEuropean stocks moved lower on Friday, after closing at a record high during the previous session.

اقرأ أكثر »

European stocks slump after European vote, shock French electionEuropean stocks slump after European vote, shock French election

European stocks slump after European vote, shock French electionEuropean stocks slump after European vote, shock French election

اقرأ أكثر »