-- US stock futures fell as traders braced for jobs data that will be critical in determining the health of the US economy and the size of a Federal Reserve interest rate cut later this month.Nasdaq 100 contracts were down more than 1% while the S&P 500 was set for a fourth day of declines. Nvidia Corp. dropped 1.6% in premarket trading as chipmakers slid following disappointing guidance by Broadcom Inc.

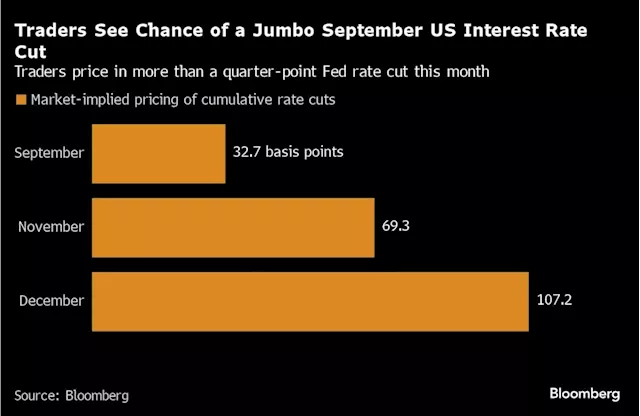

Swap contracts are fully pricing in 25 basis points of cuts when Fed officials meet in two-weeks time, with a roughly one-in-three chance of a 50 basis-point reduction. Even so, traders at Citigroup Inc. are anticipating even deeper cuts, wagering on three half-points of easing this year. Forecasters anticipate Friday’s report will show a bounce in hiring and a tick lower in the unemployment rate in August, marking a stabilization after July. Payrolls probably rose by 165,000 last month following July’s 114,000 increase, according to the median estimate in a Bloomberg survey of economists. Unemployment probably edged down to 4.2%.

In Europe, a key measure of euro-zone wage growth eased, proving further assurance to European Central Bank officials seeking to lower interest rates next week. Should inflation continue to abate, borrowing costs will be lowered every quarter until they reach 2.5%, according to a Bloomberg survey.Currency strategists see a strong chance the yen will test its August high versus the dollar if the payrolls data boost bets for a 50 basis-point move.

المملكة العربية السعودية أحدث الأخبار, المملكة العربية السعودية عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

Nasdaq pulls ahead, stocks mixed ahead of August jobs dataThe Nasdaq Composite (^IXIC) pulls away with a minor win in Thursday's session, closing the day higher by 0.25%. The Dow Jones Industrial Average (^DJI) and ...

Nasdaq pulls ahead, stocks mixed ahead of August jobs dataThe Nasdaq Composite (^IXIC) pulls away with a minor win in Thursday's session, closing the day higher by 0.25%. The Dow Jones Industrial Average (^DJI) and ...

اقرأ أكثر »

Stock market today: Stocks stumble to start September as crucial jobs report lies aheadWall Street is hunkering down after a roller-coaster August, with the prospect of a potentially stormy September ahead.

Stock market today: Stocks stumble to start September as crucial jobs report lies aheadWall Street is hunkering down after a roller-coaster August, with the prospect of a potentially stormy September ahead.

اقرأ أكثر »

Dollar, Stocks Face Pressure Ahead of US Jobs Data: Markets Wrap(Bloomberg) -- US stocks and an index of the dollar fell ahead of jobs data due Friday that will help determine the size of a Federal Reserve rate cut this...

Dollar, Stocks Face Pressure Ahead of US Jobs Data: Markets Wrap(Bloomberg) -- US stocks and an index of the dollar fell ahead of jobs data due Friday that will help determine the size of a Federal Reserve rate cut this...

اقرأ أكثر »

Nasdaq, stocks fall ahead of Nvidia earnings: Market CloseUS stocks (^DJI, ^IXIC, ^GSPC) close Wednesday in negative territory, the tech-heavy Nasdaq Composite dropping by 1.12% just before Nvidia (NVDA) is due to...

Nasdaq, stocks fall ahead of Nvidia earnings: Market CloseUS stocks (^DJI, ^IXIC, ^GSPC) close Wednesday in negative territory, the tech-heavy Nasdaq Composite dropping by 1.12% just before Nvidia (NVDA) is due to...

اقرأ أكثر »

Premarket: World stocks mixed after Wall Street extends losses as technology and energy stocks fallSeveral other reports this week will help give a clearer picture of the economy for the Fed and Wall Street

Premarket: World stocks mixed after Wall Street extends losses as technology and energy stocks fallSeveral other reports this week will help give a clearer picture of the economy for the Fed and Wall Street

اقرأ أكثر »