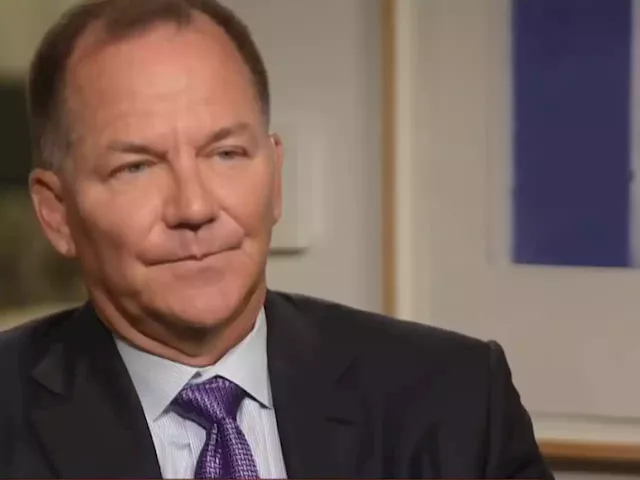

“‘You can’t think of a worse environment than where we are right now for financial assets…Clearly you don’t want to own bonds and stocks.’”

— Paul Tudor Jones, Tudor Investment Corp. That cheery conclusion comes courtesy of Paul Tudor Jones, the billionaire investor who famously called the 1987 stock market crash and who had previously raised alarm over mounting inflation pressures.In an interview with CNBC on Tuesday, the hedge-fund manager said investors are in “uncharted” territory that should make capital preservation their top priority.

Stocks have stumbled in 2022 as Treasury yields have soared from low levels, with investors attempting to get a grip on a Federal Reserve policy that is now expected to deliver outsize interest rate increases and rapidly shrink its balance sheet as it plays catchup with inflation running at a four-decade high. Investors increasingly fear the backdrop could lead to a recession as the Fed tightens monetary policy in an effort to get inflation under control.

Both stocks and bonds suffered a miserable April, with the S&P 500 SPX, +0.75% sliding nearly 9% and the JPMorgan U.S. Aggregate Bond ETF JAGG, +0.20% dropping almost 4%, according to FactSet data. Rising yields have taken a particular toll on technology and other growth stocks, with the Nasdaq Composite COMP, +0.47% down nearly 20% year to date through Monday and more than 20% below its November record finish, leaving it in a bear market. The S&P 500 was down 12.8% so far this year and slipped back into a market correction last week, while the Dow Jones Industrial Average DJIA, +0.48% was off 9% year to date.

A billionaire who was right once like a broken clock

Where then?

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

Paul Tudor Jones says he can't think of a worse financial environment for stocks or bonds right nowclick on the link and Get $10,000 Promo from us ,WE ARE HERE TO ASSIST YOU WITH CAPITAL FOR INVESTMENT 😱😱😱😱🫂 Time to buy stocks. Everybody has capitulated.

Paul Tudor Jones says he can't think of a worse financial environment for stocks or bonds right nowclick on the link and Get $10,000 Promo from us ,WE ARE HERE TO ASSIST YOU WITH CAPITAL FOR INVESTMENT 😱😱😱😱🫂 Time to buy stocks. Everybody has capitulated.

Källa: CNBC - 🏆 12. / 72 Läs mer »

Paul Tudor Jones Bets on Bitcoin v. Stocks and Bonds Due to Massive New Rate HikePaul Tudor Jones says a lot of intellectual capital is flowing into crypto and that bonds and stocks are the least reliable assets now

Paul Tudor Jones Bets on Bitcoin v. Stocks and Bonds Due to Massive New Rate HikePaul Tudor Jones says a lot of intellectual capital is flowing into crypto and that bonds and stocks are the least reliable assets now

Källa: Utoday_en - 🏆 295. / 63 Läs mer »

Norwegian stock market briefly suffers flash crashThe Norwegian stock market briefly suffered a drop of as much as 4% on Monday in the latest so-called flash crash to hit exchanges. buy eth That's why we dropped too We don't buy bitcoin We earn btc From Mining I'm ready to show 10 lucky people how to earn 1BTC ($38,951) and more daily! No referral No withdrawal fees If interested, kindly send a Dm

Norwegian stock market briefly suffers flash crashThe Norwegian stock market briefly suffered a drop of as much as 4% on Monday in the latest so-called flash crash to hit exchanges. buy eth That's why we dropped too We don't buy bitcoin We earn btc From Mining I'm ready to show 10 lucky people how to earn 1BTC ($38,951) and more daily! No referral No withdrawal fees If interested, kindly send a Dm

Källa: MarketWatch - 🏆 3. / 97 Läs mer »