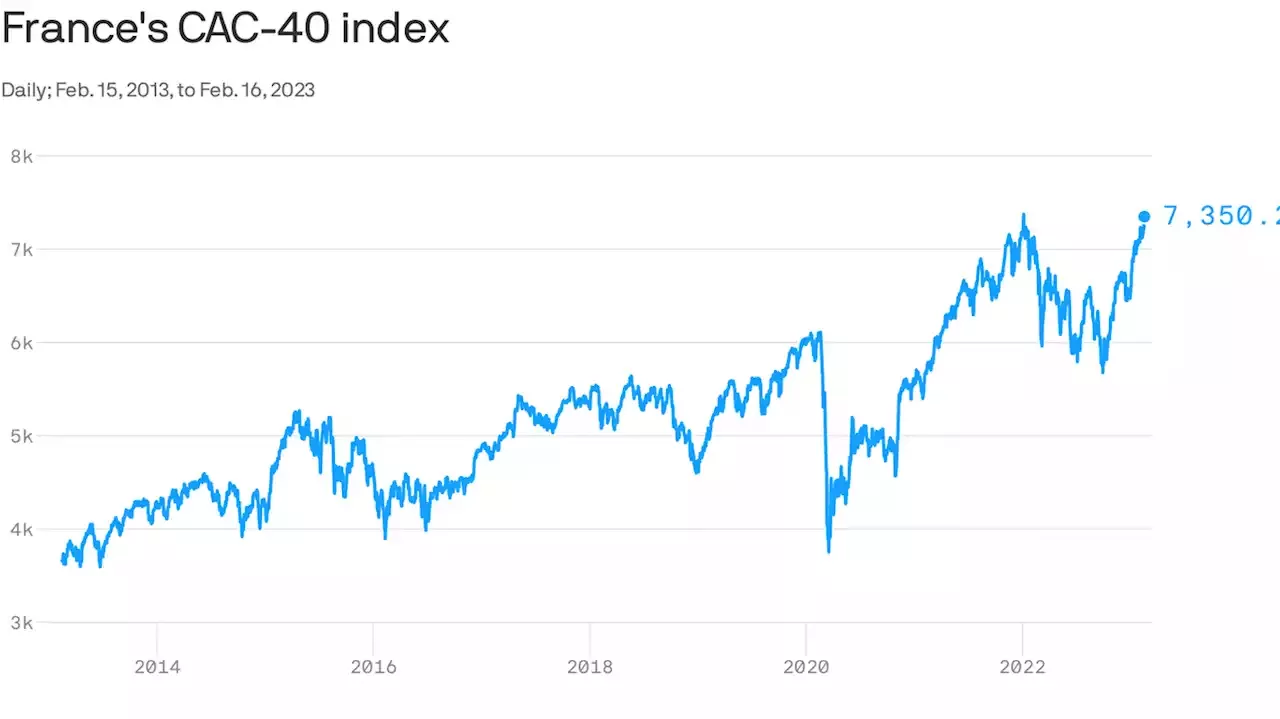

French stocks bolted from the gates this year, briefly hitting record highs on Thursday. France's blue-chip index, the CAC-40, is up nearly 14% in 2023.The performance of the Paris bourse reflects some of the surprising dynamics at play in the world economy.

Both the European and American economies have proved more resilient to the Russian energy shock than many expected, and China is now pushing for a successful reopening from COVID — all of which redounds to corporate France.Luxury conglomerate LVMH Moët Hennessy Louis Vuitton — the largest stock in the CAC-40 — will benefit from the strength of the U.S., its largest market, as well as the reopening in China, also a key growth market. Its shares are up 20% so far this year.

The weak euro also makes its products more competitive and juices its profits when they're converted back to its local currency.The CAC-40 didn't have as much ground to make up as the U.S. benchmark S&P 500 does. The French index dropped just 9.5% in 2022, compared to the S&P's 19.4% drop.European stocks have also looked relatively cheap this year compared to the U.S., analysts say, providing extra oomph to this year's rally.

Even after its rally to start the year, the CAC-40 forward price-to-earnings ratio is still under 14, compared to more than 18 for the S&P 500.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

5 things to know before the stock market opens ThursdayHere are the most important news items that investors need to start their trading day. What do you think? Then, Ford said, it would make adjustments to the battery production process, which 'could take a few weeks.' A few weeks? 🤣

5 things to know before the stock market opens ThursdayHere are the most important news items that investors need to start their trading day. What do you think? Then, Ford said, it would make adjustments to the battery production process, which 'could take a few weeks.' A few weeks? 🤣

Läs mer »