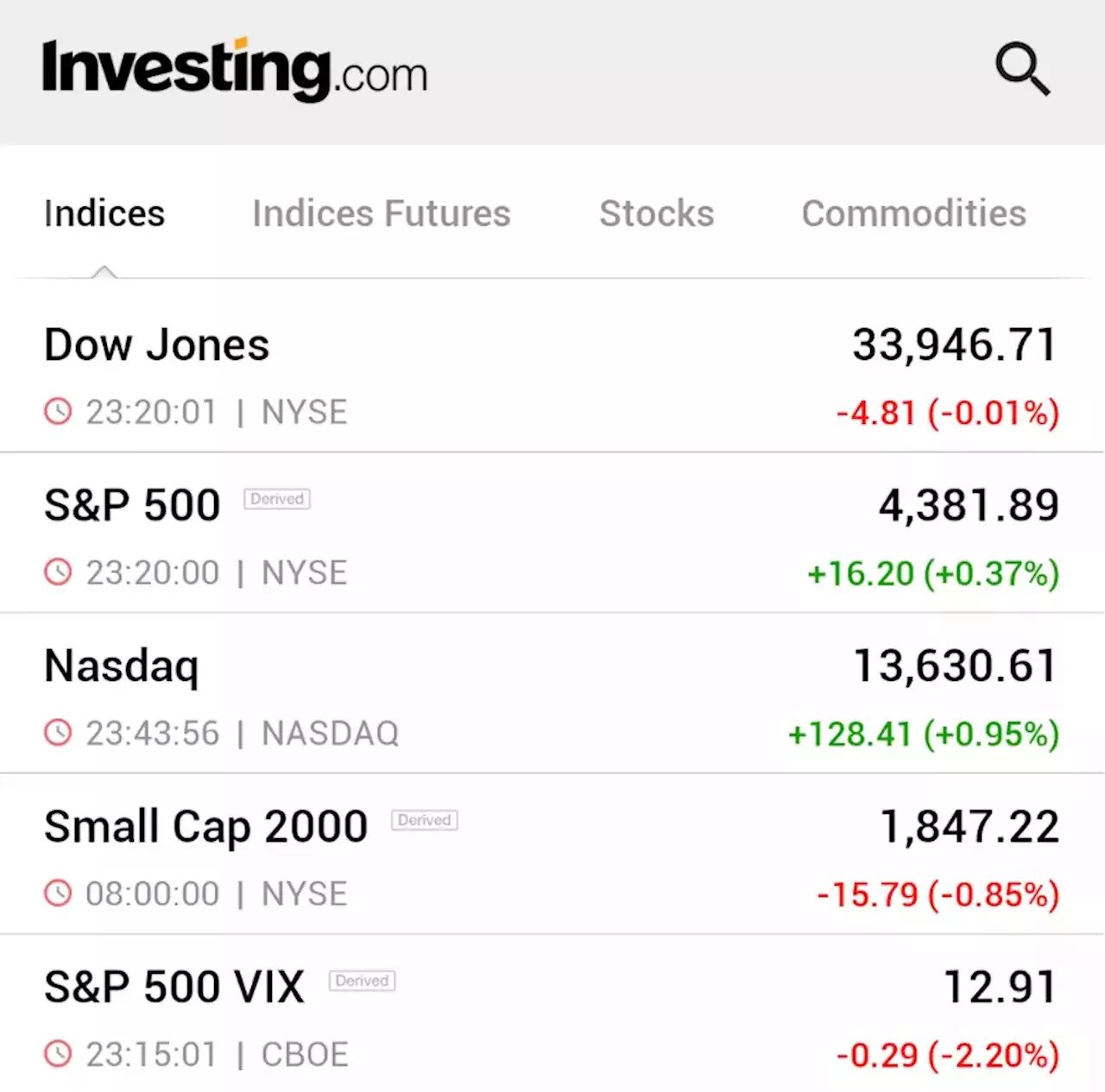

The S&P and Nasdaq ended a three day losing streak after Federal Reserve Chairman Jerome Powell wrapped up two days of testimony on Capitol Hill. Powell, as he said Wednesday, repeated his view that the Fed would likely raise rates again this year as it continues to combat inflation.

The Bank of England raised interest rates by a half of a percentage point on Thursday, its 13th consecutive raise as inflation there continues to run higher than expected. On Wednesday, Powell told lawmakers in the House that the Fed wasn’t done raising interest rates to cool , even though the central bank paused on more rate hikes last week. He appeared as part of his semi-annual testimony to Congress about the economy.Powell’s remarks suggested that more rate increases are"a pretty good guess" of what the Fed has planned assuming the economy continues on its current path. Futures traders see aThe Fed’s next move will be guided by data, Powell said. Recent inflation data has shown signs that the economy is cooling, while the labor market is holding steady.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

Stock Market Today: Dow slightly lower as Powell tells House higher rates likely aheadMarketWatch Live: Dow sneaks into positive territory near midday

Stock Market Today: Dow slightly lower as Powell tells House higher rates likely aheadMarketWatch Live: Dow sneaks into positive territory near midday

Källa: MarketWatch - 🏆 3. / 97 Läs mer »