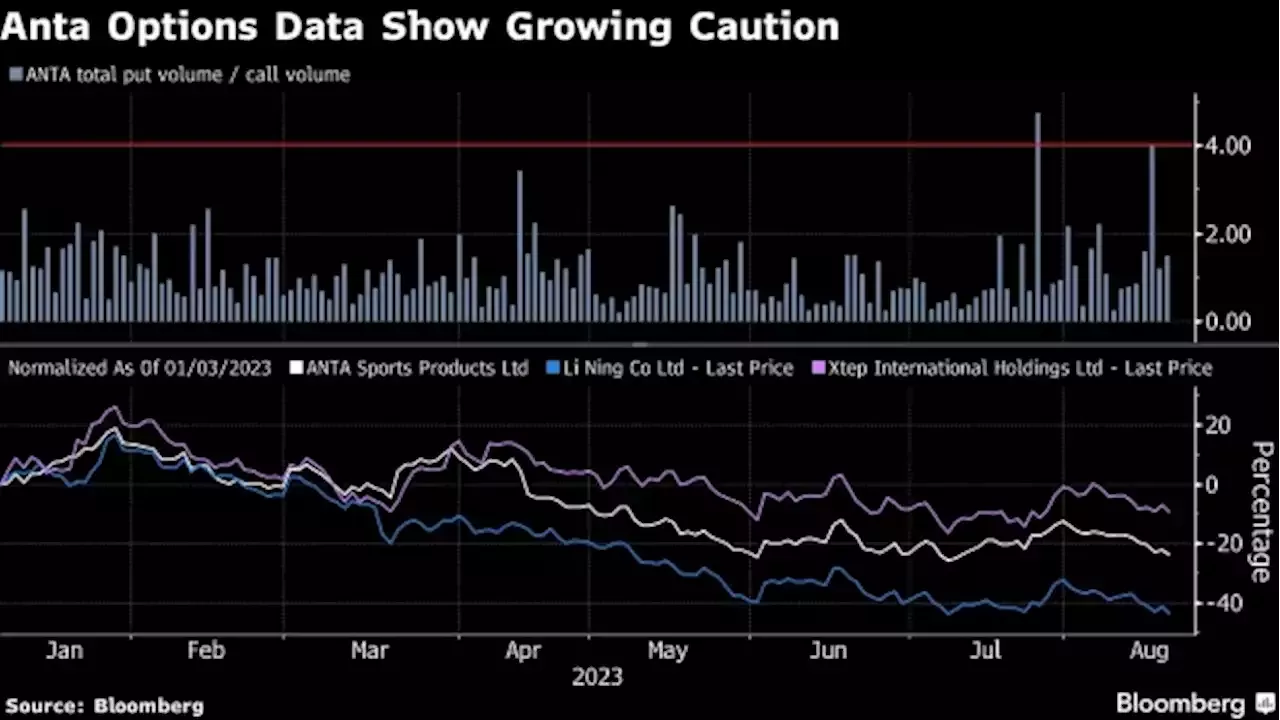

Bearish options activity and deep price target cuts from analysts signal growing caution ahead of Anta’s results Tuesday. Tepid consumer demand and competition from Nike Inc. and Adidas AG have also weighed on the sports apparel maker and its domestic peers. The company’s shares have dropped about 37% from a January high, while Li Ning Co. has more than halved since then. Meanwhile, Hong Kong’s benchmark has declined around 22%.

In the options market, Anta’s put-to-call volume ratio surged to over four times — the second highest reading for the year — on Wednesday, a sign of increasing bearishness. Additionally, Wednesday’s put volume was 3.2 times the average volume for the month so far, while the call volume was close to the average.

The pessimistic signs come as China’s latest official data show the country’s consumer recovery further lost momentum in July. Sports items and clothing sales each rose less than 3% on year after gains of at least 6% in June.They also follow weak results from domestic rivals and growing sales for foreign competitors. Beijing-based Li Ning reported first-half earnings that missed expectations amid increased discounts.