Signs of softening in the labor market are a “strong tell” that the Fed would pause rate hikes, and a “benign” reading on jobs data due on Friday would be the “last piece of the Goldilocks jigsaw,” strategist Michael Hartnett said. However, he expects more indications of a so-called hard landing from this month onward.

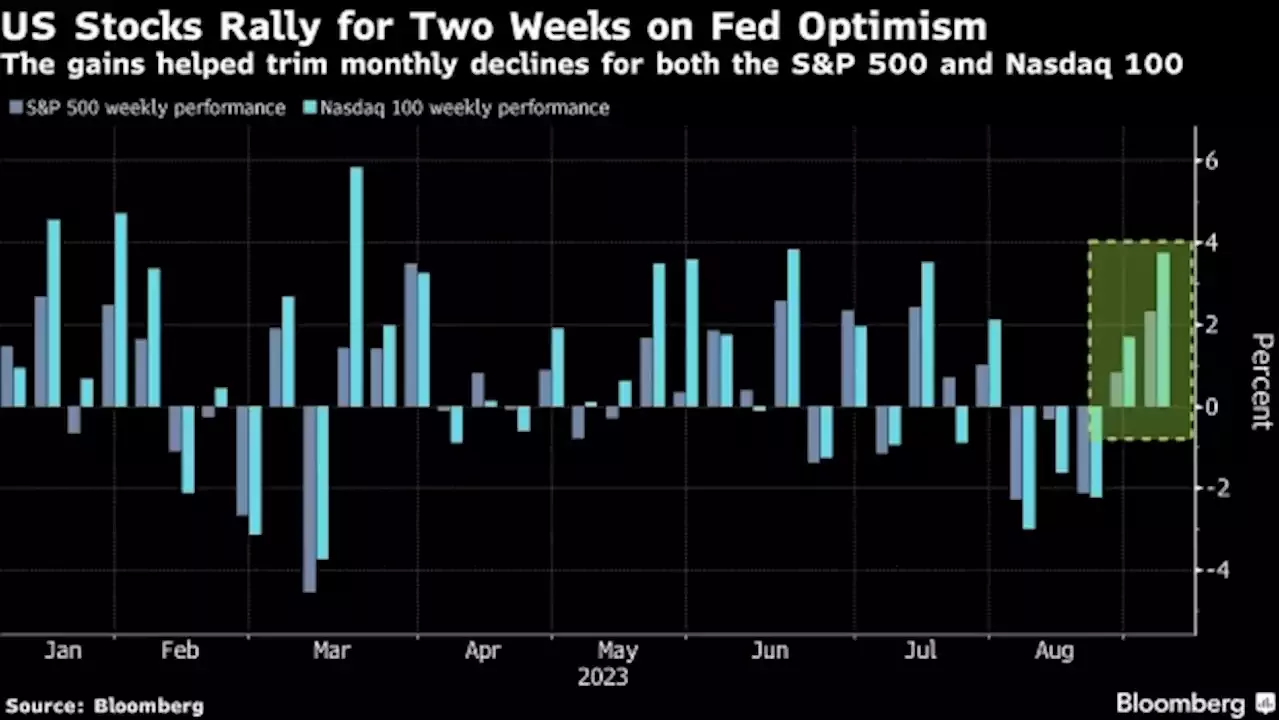

“Sell the last rate hike,” Hartnett wrote in a note dated Aug. 31. The strategist correctly predicted the US stock slump last year, and has remained bearish in 2023 even as the S&P 500 rallied 17%. Investor sentiment more recently has been supported by bets that a weakening US economy would prompt a dovish shift in the Fed’s policy outlook. The S&P 500 advanced in the past two weeks, although it still ended August with its first monthly decline since February. The focus Friday is on the Labor Department’s non-farm payrolls report, which is expected to show the US added the fewest jobs since the end of 2020 last month.

Barclays Plc strategist Emmanuel Cau also said that the market’s interpretation of bad economic data as good news for stocks only works “up to a point and so long as earnings don’t get hit.” The “benefit of lower rates due to weaker growth is fragile,” Cau wrote in a note. “With much bad news already out in Europe and China, the US consumer may hold the fate of equities.”Global stock funds had inflows of $10.3 billion in the week through Aug. 30, according to the note citing EPFR GlobalTech funds saw a 10th straight week of inflows at $5.1 billion — the largest since MayUS stock funds had inflows of $4.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

Stocks lose steam with ADP jobs, GDP data in focus: Stock market news todayWall Street's rally in stocks looked set to stall Wednesday, as investors waited for fresh data on jobs and GDP to help gauge whether Federal Reserve tightening has dented the US economy.

Stocks lose steam with ADP jobs, GDP data in focus: Stock market news todayWall Street's rally in stocks looked set to stall Wednesday, as investors waited for fresh data on jobs and GDP to help gauge whether Federal Reserve tightening has dented the US economy.

Läs mer »

Stocks mixed after PCE data signals cooling inflation: Stock market news todayStocks are eyeing a fifth straight day of gains after the Fed's preferred inflation gauge signaled a softening in pressures.

Stocks mixed after PCE data signals cooling inflation: Stock market news todayStocks are eyeing a fifth straight day of gains after the Fed's preferred inflation gauge signaled a softening in pressures.

Läs mer »

Japan's Simplex launches first ETFs focused on stocks below book valueBy Junko Fujita TOKYO (Reuters) - Japan's Simplex Asset Management said it will launch exchange-traded funds focused on undervalued stocks, including ...

Japan's Simplex launches first ETFs focused on stocks below book valueBy Junko Fujita TOKYO (Reuters) - Japan's Simplex Asset Management said it will launch exchange-traded funds focused on undervalued stocks, including ...

Läs mer »

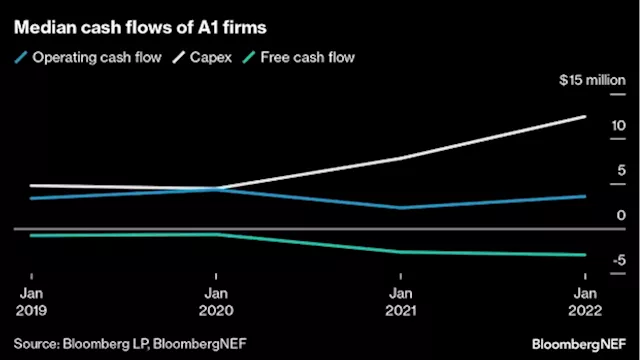

Hedge Funds Are Shorting Stocks That Biden’s IRA Was Meant to HelpA number of hedge funds have started shorting renewable energy stocks, as they bet climate stimulus will tip debt-reliant green companies over the edge by fanning inflation and triggering even higher interest rates.

Hedge Funds Are Shorting Stocks That Biden’s IRA Was Meant to HelpA number of hedge funds have started shorting renewable energy stocks, as they bet climate stimulus will tip debt-reliant green companies over the edge by fanning inflation and triggering even higher interest rates.

Läs mer »