Traders have all but priced out the prospect of easier monetary policy in Asia over the next 12 months, paring expectations for lower borrowing costs in Latin America and central Europe, swaps data show. The shift has been driven by the “higher-for-longer” rhetoric from the Federal Reserve, policymakers seeking to support their currencies and the threat of El Niño stoking inflation.

“The inflation outlook for emerging markets is becoming less certain, in contrast to the broad-based disinflation of the past four-to-five months,” said Jon Harrison, managing director for emerging-market macro strategy at GlobalData TS Lombard in London. “EM local-currency bonds could also be at risk in the coming months from a further surge in the dollar or more Fed rate hikes, but we are not at that point yet.”A hawkish trend is setting in across Asia.

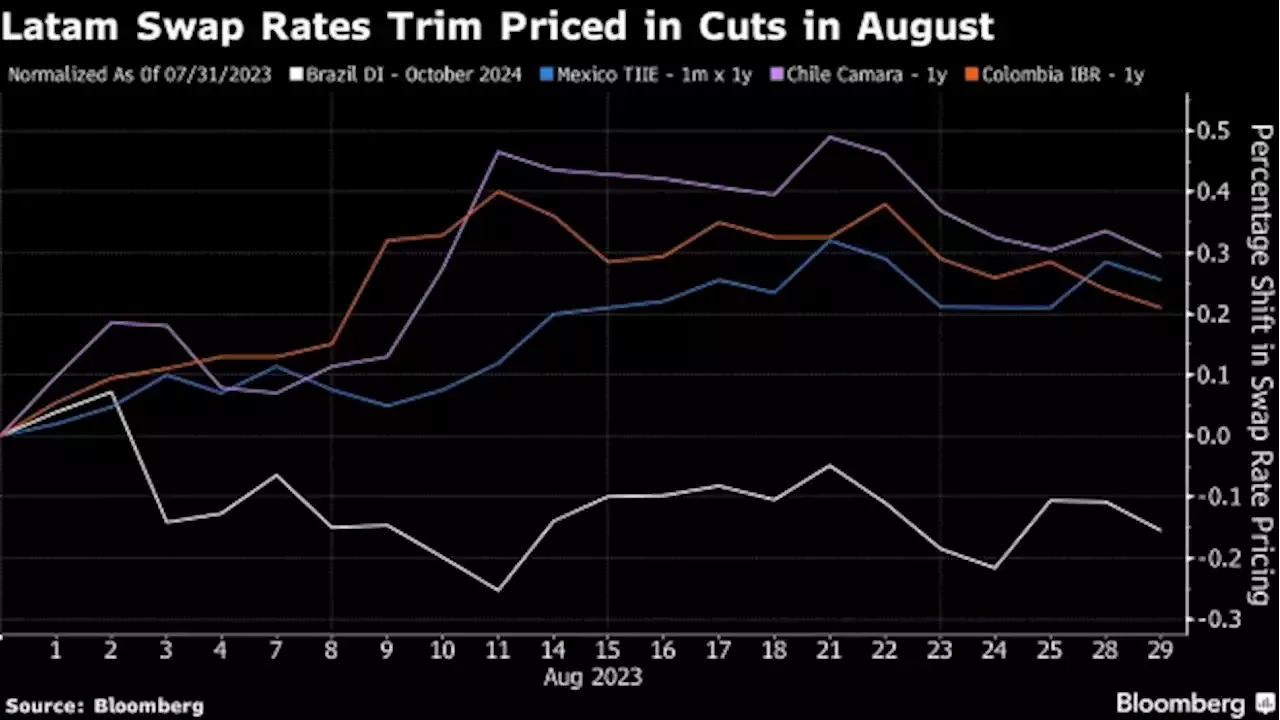

South Korean swaps are now pricing in 8 basis points of rate hikes over the next 12 months, compared with predictions for a tiny cut at the end of June. Indian contracts are anticipating 16 basis points of cuts, down from a chunkier 60 basis points that were priced in on June 30. “While there is probably low conviction among market participants for Asian central banks to hike again, the widening term premium suggests that participants see non-negligible risks of rate hikes starting again,” he said. Term premium is the extra compensation investors require to take on the risk of changing interest rates.Latin America is seeing a similar move toward more hawkish pricing, most noticeably in Chile, Mexico and Colombia.