Investors can see it in the options market, where hedging against another rout is getting more expensive. Contracts betting on a 10% decline in the SPDR S&P 500 ETF — the largest exchange-traded fund tracking the index, better known by its ticker SPY — cost 1.8 times more than options that profit from a 10% rally, data compiled by Bloomberg show.

“The next big leg of the equity rally won’t come until we get certainty on the direction of rates,” said Scott Ladner, chief investment officer at Horizon Investments. Traders are betting that the Fed will keep borrowing costs steady in September, but they also expect another rate hike before the end of the year.

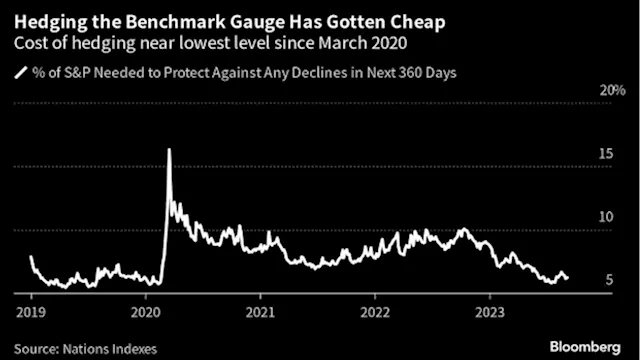

Traders who don’t think the lull in volatility will last are using the calm to pick up protection on the cheap, according to Scott Nations, president of Nations Indexes, an independent developer of volatility and option strategy indexes. The cost to protect against a resurgence in volatility is close to the cheapest it’s been since before the pandemic-fueled selloff in March 2020.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

Fear of Stock Market Dive Creeps Back as Hedging Costs ClimbThe S&P 500 Index’s surprise 16% rally this year is rewarding traders who bought in early and punishing those who’ve remained skeptical. But fear of a downturn remains.

Fear of Stock Market Dive Creeps Back as Hedging Costs ClimbThe S&P 500 Index’s surprise 16% rally this year is rewarding traders who bought in early and punishing those who’ve remained skeptical. But fear of a downturn remains.

Källa: BNNBloomberg - 🏆 83. / 50 Läs mer »

Stock market today: Wall Street drifts at the open, on track for a losing weekNEW YORK (AP) — Stocks are drifting, keeping Wall Street on track to close out its first losing week in the last three. The S&P 500 was up 0.2% early Friday. The Dow was flat and the Nasdaq composite edged up 0.3%.

Stock market today: Wall Street drifts at the open, on track for a losing weekNEW YORK (AP) — Stocks are drifting, keeping Wall Street on track to close out its first losing week in the last three. The S&P 500 was up 0.2% early Friday. The Dow was flat and the Nasdaq composite edged up 0.3%.

Källa: SooToday - 🏆 8. / 85 Läs mer »

Stocks rise at the open as Fed officials hint at rate respite: Stock market news todayStocks stepped higher on Friday, with the Nasdaq gaining as Apple's shares recovered from a two-day slump.

Stocks rise at the open as Fed officials hint at rate respite: Stock market news todayStocks stepped higher on Friday, with the Nasdaq gaining as Apple's shares recovered from a two-day slump.

Källa: YahooFinanceCA - 🏆 47. / 63 Läs mer »

China Stock Regulator Vows Market Support After Investor MeetingChina’s securities regulator pledged more measures to support capital markets and said it recently met with investors including BlackRock Inc. and Bridgewater Associates to hear their suggestions.

China Stock Regulator Vows Market Support After Investor MeetingChina’s securities regulator pledged more measures to support capital markets and said it recently met with investors including BlackRock Inc. and Bridgewater Associates to hear their suggestions.

Källa: BNNBloomberg - 🏆 83. / 50 Läs mer »

Stocks rise as Fed officials hint at rate respite: Stock market news todayStocks stepped higher on Friday, with the Nasdaq gaining as Apple's shares recovered from a two-day slump.

Stocks rise as Fed officials hint at rate respite: Stock market news todayStocks stepped higher on Friday, with the Nasdaq gaining as Apple's shares recovered from a two-day slump.

Källa: YahooFinanceCA - 🏆 47. / 63 Läs mer »

Stock market drives U.S. households to record wealthFed data also points to a rebound in property values

Stock market drives U.S. households to record wealthFed data also points to a rebound in property values

Källa: globeandmail - 🏆 5. / 92 Läs mer »