Awkward Encounters: Pushing Limits of EmbarrassmentHere's why Suncor and Enbridge are two top energy stocks investors can buy today and hold for a decade or longer. The post 2 Top Canadian Energy Stocks to Buy Right Now appeared first on The Motley Fool Canada.OTTAWA — The Bank of Canada was watching its words at its last interest rate announcement, in fear of spurring speculation that rate cuts are coming any time soon.

The Bank of Canada held its key interest rate steady at five per cent earlier this month amid signs of the economy weakening. " also considerCALGARY — A growing number of forecasts are calling for the return of US$100 oil before the end of the year — a prospect that could put even more pressure on consumers and make it harder for central bankers to rein in inflation.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

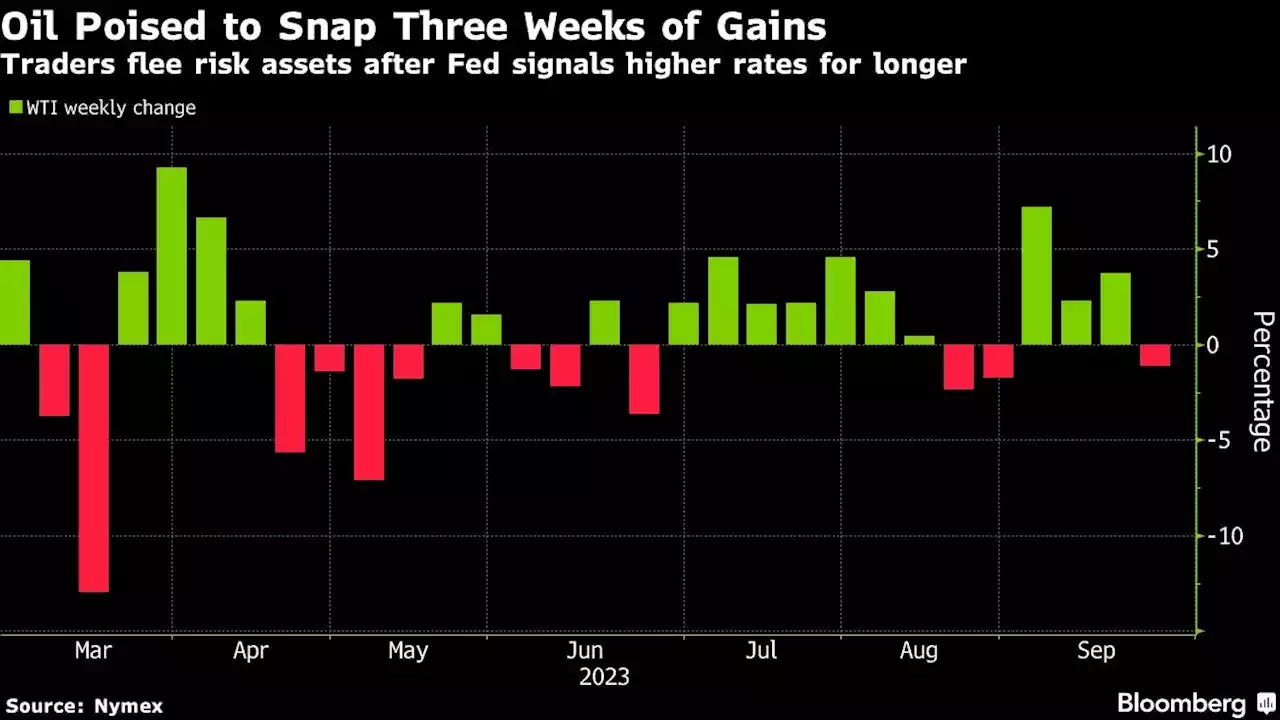

Stocks struggle as oil surge sets stage for hawkish FedAsian stocks struggled for headway on Wednesday while 10-year U.S. Treasury yields stood at 16-year highs as surging oil prices drive inflation and set the scene for the Federal Reserve to project interest rates staying higher for longer. Higher energy costs led to a bigger-than-expected spike in Canadian inflation, overnight data showed, lifting the loonie and triggering selling in the Treasury market. Benchmark 10-year Treasury yields hit their highest since 2007 at 4.371% overnight and were last at 4.36%.

Stocks struggle as oil surge sets stage for hawkish FedAsian stocks struggled for headway on Wednesday while 10-year U.S. Treasury yields stood at 16-year highs as surging oil prices drive inflation and set the scene for the Federal Reserve to project interest rates staying higher for longer. Higher energy costs led to a bigger-than-expected spike in Canadian inflation, overnight data showed, lifting the loonie and triggering selling in the Treasury market. Benchmark 10-year Treasury yields hit their highest since 2007 at 4.371% overnight and were last at 4.36%.

Läs mer »

Stocks struggle as oil surge sets stage for hawkish FedBy Tom Westbrook SINGAPORE (Reuters) - Asian stocks struggled for headway on Wednesday while 10-year U.S. Treasury yields stood at 16-year highs as ...

Stocks struggle as oil surge sets stage for hawkish FedBy Tom Westbrook SINGAPORE (Reuters) - Asian stocks struggled for headway on Wednesday while 10-year U.S. Treasury yields stood at 16-year highs as ...

Läs mer »