SaltWire's Atlantic regional weather forecast for October 2, 2023 | SaltWireNEW YORK - Strong upcoming earnings results could reverse the decline in mega-cap technology and growth stocks, which have been hammered by the rise in Treasury yields and are trading at their cheapest levels in six years by one measure, according to Goldman Sachs strategists.

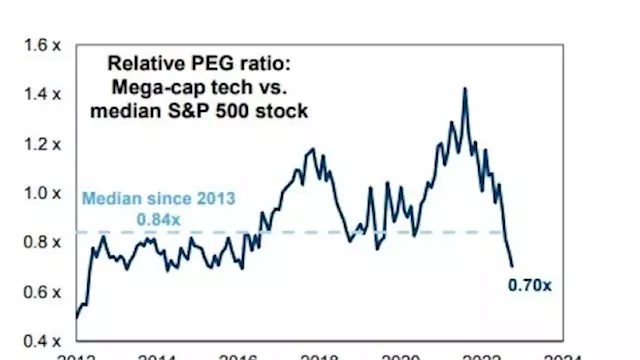

Those declines have pushed mega-cap forward price-to-earnings ratios down by a collective 20% over the last two months, leaving them trading at their largest discount to the market based on long-term growth since January 2017, Goldman Sachs said in a note dated Oct. 1. At the same time, the group is expected to post sales growth of 11% in the third quarter, compared with a 1% improvement for the S&P 500, the firm noted.

"The divergence between falling valuations and improving fundamentals represents an opportunity for investors," they wrote. The average recommended allocation to equities in balanced funds remained unchanged at 53% in September, below the benchmark of 60%, Subramanian noted. Falling sentiment has historically been a signal of broad gains over the following 12 months, she noted.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

Strong earnings will reverse decline in megacap tech stocks: Goldman SachsStrong upcoming earnings results could reverse the decline in mega-cap technology and growth stocks, which have been hammered by the rise in Treasury yields and are trading at their cheapest levels in six years by one measure, according to Goldman Sachs strategists. The so-called Magnificent Seven group of megacap stocks -Apple, Microsoft, Amazon.com, Alphabet, Nvidia, Tesla, and Meta Platforms - have fallen 7% over the last two months, compared with a 3% decline in the broad S&P 500, as Treasury yields jumped more than 60 basis points to 16-year highs. Those declines have pushed mega-cap forward price-to-earnings ratios down by a collective 20% over the last two months, leaving them trading at their largest discount to the market based on long-term growth since January 2017, Goldman Sachs said in a note dated Oct. 1.

Strong earnings will reverse decline in megacap tech stocks: Goldman SachsStrong upcoming earnings results could reverse the decline in mega-cap technology and growth stocks, which have been hammered by the rise in Treasury yields and are trading at their cheapest levels in six years by one measure, according to Goldman Sachs strategists. The so-called Magnificent Seven group of megacap stocks -Apple, Microsoft, Amazon.com, Alphabet, Nvidia, Tesla, and Meta Platforms - have fallen 7% over the last two months, compared with a 3% decline in the broad S&P 500, as Treasury yields jumped more than 60 basis points to 16-year highs. Those declines have pushed mega-cap forward price-to-earnings ratios down by a collective 20% over the last two months, leaving them trading at their largest discount to the market based on long-term growth since January 2017, Goldman Sachs said in a note dated Oct. 1.

Källa: YahooFinanceCA - 🏆 47. / 63 Läs mer »

Strong earnings will reverse decline in megacap tech stocks: Goldman SachsThe so-called Magnificent Seven have fallen 7% over the last two months, compared with a 3% decline in the broad S&P 500

Strong earnings will reverse decline in megacap tech stocks: Goldman SachsThe so-called Magnificent Seven have fallen 7% over the last two months, compared with a 3% decline in the broad S&P 500

Källa: globeandmail - 🏆 5. / 92 Läs mer »

Goldman Sees Earnings-Led Rally in Big Tech Stocks After RoutUS technology stocks may be about to turn a corner after the Nasdaq 100’s biggest monthly decline this year, according to strategists at Goldman Sachs Group Inc.

Goldman Sees Earnings-Led Rally in Big Tech Stocks After RoutUS technology stocks may be about to turn a corner after the Nasdaq 100’s biggest monthly decline this year, according to strategists at Goldman Sachs Group Inc.

Källa: BNNBloomberg - 🏆 83. / 50 Läs mer »

Japan says it’s watching currency market moves with ‘strong sense of urgency’ as yen slidesJapanese officials in a recent few weeks have said they would not rule out any options on currency market intervention

Japan says it’s watching currency market moves with ‘strong sense of urgency’ as yen slidesJapanese officials in a recent few weeks have said they would not rule out any options on currency market intervention

Källa: globeandmail - 🏆 5. / 92 Läs mer »