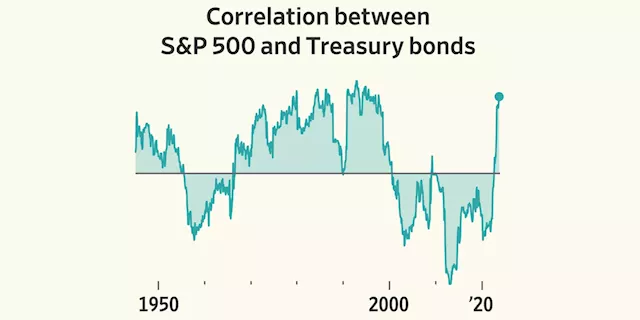

Over their 50 years of marriage, Dave and Kathy Lindenstruth adopted a time-honored Wall Street strategy to safeguard and grow their retirement nest egg: a mix of 60% U.S. stocks and 40% bonds known as the 60-40 portfolio. Now, it is failing them.

“There have been some days more recently where I’ve looked at my portfolio and gone ‘oh, crap,’” Dave Lindenstruth said. This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

Sverige Senaste nytt, Sverige Rubriker

Similar News:Du kan också läsa nyheter som liknar den här som vi har samlat in från andra nyhetskällor.

Why the Classic Stock-and-Bond Investment Strategy Isn’t WorkingHigher interest rates and inflation are upending millions of Americans’ retirement planning. Wall Street’s boilerplate mix of stocks and bonds isn’t cutting it anymore.

Why the Classic Stock-and-Bond Investment Strategy Isn’t WorkingHigher interest rates and inflation are upending millions of Americans’ retirement planning. Wall Street’s boilerplate mix of stocks and bonds isn’t cutting it anymore.

Läs mer »

Stock-market investors are 'calling the bond market's bluff' as yields jumpInvestors are questioning the idea that the bond market is the smartest money in the room: DataTrek’s Colas

Stock-market investors are 'calling the bond market's bluff' as yields jumpInvestors are questioning the idea that the bond market is the smartest money in the room: DataTrek’s Colas

Läs mer »

Stock Market Today: Tesla Stock Sinks, Netflix Surges and Earnings Deluge ContinuesGovernment bonds sell off again; Netflix stock surges premarket

Stock Market Today: Tesla Stock Sinks, Netflix Surges and Earnings Deluge ContinuesGovernment bonds sell off again; Netflix stock surges premarket

Läs mer »

Why stock-market investors are fixated on 5% as 10-year Treasury yield nears key thresholdVivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Why stock-market investors are fixated on 5% as 10-year Treasury yield nears key thresholdVivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Läs mer »