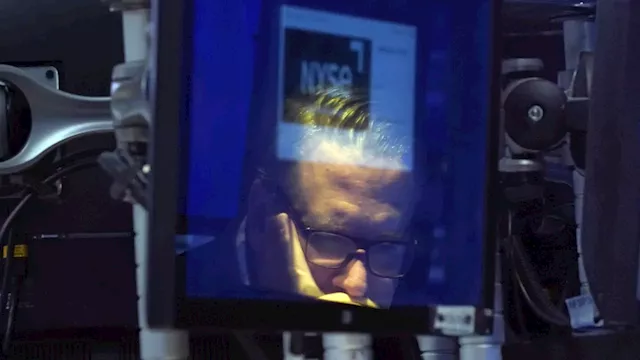

Investing.com-- Most Asian stocks moved in a flat-to-low range on Wednesday as weak China data and anticipation of a Federal Reserve rate decision kept sentiment frail, while the Nikkei rose sharply after the Bank of Japan signaled few changes to its ultra-dovish policy.

The central bank is expected to keep rates on hold, but is also likely to reiterate its higher-for-longer stance on rates- a scenario that heralds more pain for risk-driven assets. The readings indicated that stimulus measures from Beijing were so far having only a limited impact on the economy, and that more government spending was likely required to fish the Chinese economy out of a three year-long slump. This notion also kept investors largely averse to Chinese markets.

Singapore Singapore Latest News, Singapore Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Asian stocks dip on weak China PMIs; Nikkei rises on dovish BOJAsian stocks dip on weak China PMIs; Nikkei rises on dovish BOJ

Asian stocks dip on weak China PMIs; Nikkei rises on dovish BOJAsian stocks dip on weak China PMIs; Nikkei rises on dovish BOJ

Read more »

Asian stocks dip on weak China PMIs; BOJ, Fed loom over marketsAsian stocks dip on weak China PMIs; BOJ, Fed loom over markets

Asian stocks dip on weak China PMIs; BOJ, Fed loom over marketsAsian stocks dip on weak China PMIs; BOJ, Fed loom over markets

Read more »

Asian stocks sink before policy-packed week; Nikkei hit by pre-BOJ jittersAsian stocks sink before policy-packed week; Nikkei hit by pre-BOJ jitters

Asian stocks sink before policy-packed week; Nikkei hit by pre-BOJ jittersAsian stocks sink before policy-packed week; Nikkei hit by pre-BOJ jitters

Read more »

Stock market today: Asian shares slip after S&P 500 slips ahead of Fed interest rate decisionAsian shares are mostly lower ahead of a Federal Reserve decision this week on interest rates. U.S. futures gained while oil prices fell more than $1 a barrel. On Friday, stocks stumbled on Wall Street. The S&P 500 fell 0.5% and is now in what's called a correction, down 10% from the peak for this year that it hit in July. The Dow fell 1.

Stock market today: Asian shares slip after S&P 500 slips ahead of Fed interest rate decisionAsian shares are mostly lower ahead of a Federal Reserve decision this week on interest rates. U.S. futures gained while oil prices fell more than $1 a barrel. On Friday, stocks stumbled on Wall Street. The S&P 500 fell 0.5% and is now in what's called a correction, down 10% from the peak for this year that it hit in July. The Dow fell 1.

Read more »

Stock market today: Asian shares slip after S&P 500 slips ahead of Fed interest rate decisionAsian shares are mostly lower ahead of a Federal Reserve decision this week on interest rates.

Stock market today: Asian shares slip after S&P 500 slips ahead of Fed interest rate decisionAsian shares are mostly lower ahead of a Federal Reserve decision this week on interest rates.

Read more »