: CSCO) than the previous dips down established in mid-May and in early July. To a price chart analyst, such a pattern is not bullish as the trend downward is confirmed. That doesn’t stop those who want to pick bottoms and come away as stock trading heroes. The 2-days of October buying have taken Cisco back up to 41.82. Look for relief rally blockages at the declining 50-day moving average, $44.20 and at the previous resistance of just above $46.

There are many more examples of potential relief rallies now going on with many well-known, name brand stocks. Institutional investors will be looking to the CPI and PPI numbers to be released later this month to gauge how much further the Fed might go with interest rate hikes. That will be telling for stocks now being purchased.

ประเทศไทย ข่าวล่าสุด, ประเทศไทย หัวข้อข่าว

Similar News:คุณยังสามารถอ่านข่าวที่คล้ายกันนี้ซึ่งเรารวบรวมจากแหล่งข่าวอื่น ๆ ได้

Recession Watch: Bear Market Deepens As Fed Official Warns Rate Hikes Will Trigger 'Failures' Around Global EconomyHere's how the housing market, stock market, labor market, and the Fed are faring this week. C’mon man the rate hikes didn’t happen over night 🤡 October 24th 2022 The collapse. It’s over _Kriesz_ keep it up to trigger the bottom 🤭

Recession Watch: Bear Market Deepens As Fed Official Warns Rate Hikes Will Trigger 'Failures' Around Global EconomyHere's how the housing market, stock market, labor market, and the Fed are faring this week. C’mon man the rate hikes didn’t happen over night 🤡 October 24th 2022 The collapse. It’s over _Kriesz_ keep it up to trigger the bottom 🤭

อ่านเพิ่มเติม »

By the Numbers: Tech Jobs Keeping Economy Hot, Tanking Stock MarketMore than 250,000 new jobs were created last month — a historically-low jobless rate — and it’s causing the stock market to tank. Bullshit lies and nonsense as usual

By the Numbers: Tech Jobs Keeping Economy Hot, Tanking Stock MarketMore than 250,000 new jobs were created last month — a historically-low jobless rate — and it’s causing the stock market to tank. Bullshit lies and nonsense as usual

อ่านเพิ่มเติม »

U.S. cannabis stocks continue rallying as investors ponder potential de-schedulingU.S. cannabis stocks continued to move up in pre-market trades on Friday, as the AdvisorShares Pure US Cannabis ETF undefined jumped another 9% following...

U.S. cannabis stocks continue rallying as investors ponder potential de-schedulingU.S. cannabis stocks continued to move up in pre-market trades on Friday, as the AdvisorShares Pure US Cannabis ETF undefined jumped another 9% following...

อ่านเพิ่มเติม »

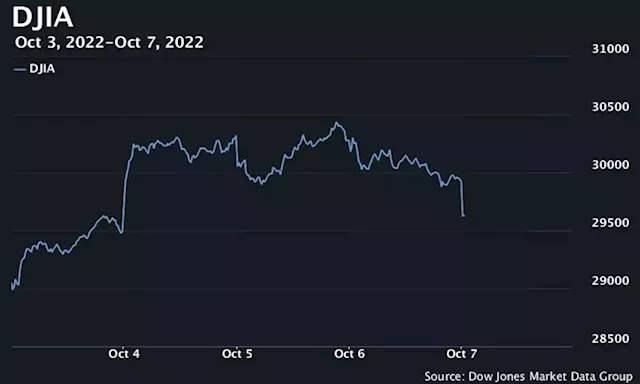

U.S. stocks slump after jobs data disappoint, chipmaker issues profit warningU.S. stocks slumped at the open on Friday as investors digested another report showing the U.S. labor market is starting to deteriorate. The Dow Jones Industrial Average fell 268 points, or 0.9%, to 29,658: I think they slump because labor market is stronger than expected 😅 Say goodbye to 'pivot' narrative (for now) and hello to lower equity prices. The Fed is still simply reacting. They need to move more forcefully and immediately implement emergency inter-meeting rate hikes to contain inflation. We are going to keep heading lower

U.S. stocks slump after jobs data disappoint, chipmaker issues profit warningU.S. stocks slumped at the open on Friday as investors digested another report showing the U.S. labor market is starting to deteriorate. The Dow Jones Industrial Average fell 268 points, or 0.9%, to 29,658: I think they slump because labor market is stronger than expected 😅 Say goodbye to 'pivot' narrative (for now) and hello to lower equity prices. The Fed is still simply reacting. They need to move more forcefully and immediately implement emergency inter-meeting rate hikes to contain inflation. We are going to keep heading lower

อ่านเพิ่มเติม »