Since they become worth more than the underlying coins as the deposit earns interest, eTokens don’t have a 1:1 correspondence with the underlying asset in terms of value.eTokens. But if they do this, the protocol will send them debt tokens to balance out the assets created.

If a user’s health score falls below 1, then an increasing discount is given out to the liquidator based on how bad the health score is. The worse the health score, the greater the discount to the liquidator. This is intended to make sure that someone will always liquidate an account before it accumulates too much bad debt.

After receiving the 30 million DAI, borrower deposited 20 million of it to Euler. Euler then responded by minting approximately 19.6 million eDAI and sending it to borrower. In response, Euler minted another 200 million dDai and sent it to borrower, bringing borrower’s total debt to $400 million. Next, Euler minted an additional 5.08 million dDAI and sent it to liquidator. This brought liquidator’s debt to $260 million. Finally, Euler transferred approximately 310.9 million eDAI from borrower to liquidator, completing the liquidation process.

According to a March 13 report from Omniscia, the primary problem with Euler was its “donateToReserves” function. This function allowed the attacker to a standard ERC-20 “transfer” function. This seems to imply that the attacker could have transferred their eTokens to another random user or to the null address instead of donating, pushing themselves into insolvency anyway.However, the attacker did choose to donate the funds rather than transfer them, suggesting the transfer would not have worked.

A representative from DeFi developer Spool told Cointelegraph that technological risk is an intrinsic feature of the DeFi ecosystem. Although it can’t be eliminated, it can be mitigated through models that properly rate the risks of protocols.to Spool’s risk management white paper, it uses a “risk matrix” to determine the riskiness of protocols.

Only that it's right I use only Ownr wallet

The March 13 flash loan attack against Euler Finance resulted in over $195 million in losses. It caused a contagion to spread through multiple decentralized finance (DeFi) protocols, and at least 11 protocols other than Euler suffered losses due to the attack.

Crypto will change 2023

Hee didd itt inn 2023.

ประเทศไทย ข่าวล่าสุด, ประเทศไทย หัวข้อข่าว

Similar News:คุณยังสามารถอ่านข่าวที่คล้ายกันนี้ซึ่งเรารวบรวมจากแหล่งข่าวอื่น ๆ ได้

M11 Credit Resumes Crypto Lending on Maple Finance After FTX-Spurred PauseThe firm introduced an upgraded credit underwriting process and appointed a new head of credit. The developments came after M11 Credit suffered $36 million of loan defaults on lending protocol Maple Finance following FTX’s November collapse. M11Credit maplefinance FTX_Official sndr_krisztian Going to be a huge year for $mpl maplefinance

M11 Credit Resumes Crypto Lending on Maple Finance After FTX-Spurred PauseThe firm introduced an upgraded credit underwriting process and appointed a new head of credit. The developments came after M11 Credit suffered $36 million of loan defaults on lending protocol Maple Finance following FTX’s November collapse. M11Credit maplefinance FTX_Official sndr_krisztian Going to be a huge year for $mpl maplefinance

อ่านเพิ่มเติม »

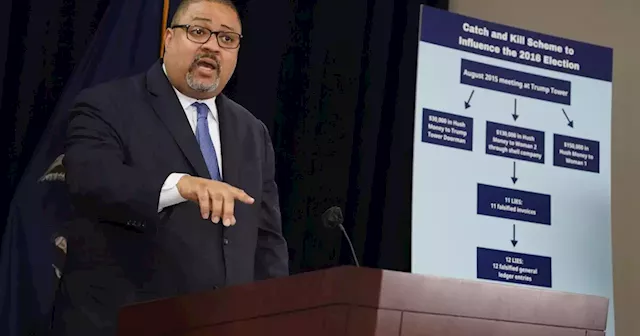

FEC: Trump-Stormy case ‘not a campaign finance violation’A key member of the FEC today rejected the ManhattanDA’s indictment of Donald Trump as a violation of federal election laws. “It's not a campaign finance violation. It's not a reporting violation of any kind,” said FEC Commissioner TXElectionLaw. FEC ManhattanDA TXElectionLaw Good one! CarolineWren FEC ManhattanDA TXElectionLaw Surely Alvin did not make a mistake? When he finally comes to his senses, he owes the entire country an apology. And then he can get off his fat ass and start prosecuting the real criminals all over NYC.

FEC: Trump-Stormy case ‘not a campaign finance violation’A key member of the FEC today rejected the ManhattanDA’s indictment of Donald Trump as a violation of federal election laws. “It's not a campaign finance violation. It's not a reporting violation of any kind,” said FEC Commissioner TXElectionLaw. FEC ManhattanDA TXElectionLaw Good one! CarolineWren FEC ManhattanDA TXElectionLaw Surely Alvin did not make a mistake? When he finally comes to his senses, he owes the entire country an apology. And then he can get off his fat ass and start prosecuting the real criminals all over NYC.

อ่านเพิ่มเติม »

Despite Denver’s new campaign finance rules, outside money may have won the raceDenver’s new campaign finance rules, the Fair Elections fund, broadened the field of candidates for mayor. But the two top candidates brought in the most money, mainly from outside groups. Why does it take so long to count all the votes ? AAlbaladejo I thought Democrats were against free spending in elections? AAlbaladejo Power and control are top political priorities for Dems and Republicans. They don’t give a f… about what’s best for everyone

Despite Denver’s new campaign finance rules, outside money may have won the raceDenver’s new campaign finance rules, the Fair Elections fund, broadened the field of candidates for mayor. But the two top candidates brought in the most money, mainly from outside groups. Why does it take so long to count all the votes ? AAlbaladejo I thought Democrats were against free spending in elections? AAlbaladejo Power and control are top political priorities for Dems and Republicans. They don’t give a f… about what’s best for everyone

อ่านเพิ่มเติม »

Alaska Housing Finance Corporation opens Anchorage rental voucher wait listThe vouchers allow people to find housing anywhere in the municipality including Girdwood, Eagle River and Eklutna.

Alaska Housing Finance Corporation opens Anchorage rental voucher wait listThe vouchers allow people to find housing anywhere in the municipality including Girdwood, Eagle River and Eklutna.

อ่านเพิ่มเติม »